Looking for alternatives to Revolut for your business's FX conversion and hedging needs? Well look no further! With the economy becoming increasingly globalised, getting your currency conversion and hedging strategies spot-on is key for staying ahead of the game.

Revolut has made its mark and become the go-to choice for many businesses… but you already knew that. You’re here because you’re interested in the plethora of other options out there that might suit your vibe better. In this article, we'll explore the cream of the crop of alternatives to Revolut for business FX conversion and hedging, highlighting their key features, costs, and benefits. So, buckle up as we help you find your business’s perfect match!

Understanding FX Conversion and Hedging (For Dummies)

Before we get into the nitty-gritty of these alternatives, let's zoom out for a sec and talk about why efficient FX conversion and hedging are such big deals in today's business landscape.

FX Conversion

Think of FX conversion as the bread and butter of international trade and investment. It involves converting one currency into another at the prevailing exchange rate, allowing companies to conduct international trade, invest in foreign markets, or manage overseas operations. So, for businesses that want to do any of the above, FX conversion is UNAVOIDABLE, and they want the best deal when converting their money.

Hedging: A Risk Management Strategy

And then there’s hedging. Sometimes the best offence is a good defence, and hedging is your defence against volatile currency fluctuations (AKA defence against the dark arts). Any business that buys and sells in other countries, sends money overseas, or has staff, or business partners abroad is exposed to foreign currency risk. Because of this, smart fellers employ hedging as a risk management strategy to dodge potential losses in case the currencies start swinging wildly, and trust me, they can be wild. If you want to learn more about FX hedging, we’ve got an excellent article here just for you.

So, it’s no wonder that businesses are on the lookout for top-notch FX services that not only handle conversions like a pro but also offer a toolbox of hedging solutions to keep them safe from foreign currency risk. Whether you're exchanging currencies to facilitate international trade or hedging against currency fluctuations, having a reliable FX service is crucial to minimise FX risk and maximise profitability.

What to Look for in a Business FX Service?

When evaluating alternatives to Revolut, some features standout from the rest. Join us as we explore the most coveted features in a FX service to help you make an informed decision.

Security and Regulatory Compliance

First things first, let’s talk security. Your business's finances are no joke, so you'll want a service that takes security seriously. Look for companies with the appropriate regulatory licences and robust security measures to protect your sensitive financial data. Encryption, secure authentication-the works. Trustworthy companies often provide details about their regulatory compliance on their website or through customer support.

Competitive Exchange Rates

Next, we got rates. Choosing a FX service that offers competitive exchange rates can make a world of difference to your bottom line. Compare rates offered by various alternatives to Revolut to ensure you're getting the most bang for your buck. Keep in mind that exchange rates can fluctuate, so it's essential to find a service that provides real-time rates and transparent pricing.

Ease of Use and Customer Support

Ease of use is another biggie. Using a FX service to execute transactions shouldn't be a complicated affair. Nobody wants to spend hours wrestling with a clunky interface, so make sure you're picking a service that's so intuitive that even your grandma could pick up.

And of course, top-notch customer support is essential for those times when things don't go quite to plan. Prioritise services that provide prompt and reliable customer support so you can address any complications that may arise, just don’t forget to be nice 🙂.

Transparency

No secrets here. You want a service that's upfront and honest about everything, from fees to exchange rates. Transparency is key to building trust with your service provider and keeping your business running smoothly. Those pesky hidden fees won’t be haunting you anymore.

Advanced Features

And lastly, if you’re not satisfied with the above, keep an eye out for those advanced features for more intricate and sophisticated risk management options. There are plenty of epic features on offer, like market reporting tools, market insights, and automated hedging solutions (our thing btw 😎). Don’t be afraid to take your FX game to the next level.

Top Revolut Alternatives

Now let’s get into the meat and potatoes of why we’re here - the top contenders to Revolut. These options offer robust features and competitive advantages that make them worth considering as an alternative. Let’s meet the candidates!

First up, we’ve got TransferWise (or Wise, as they like to call themselves now). These guys are all about their transparent pricing structure and killer exchange rates, making them a favourite among businesses with global ambitions. TransferWise makes converting funds and juggling multiple currencies a breeze, while providing a user-friendly platform, real-time rates, and proper compliance with financial regulations.

Next up on the list is OFX, a reliable option for businesses looking to save serious cash with cost-effective FX solutions. With their technology and low fees, OFX offers rates that make your wallet sing. They also provide personalised services, 24/7 global support along with a comprehensive suite of tools to facilitate super smooth international transactions.

A standout feature of OFX is their dedicated market commentary and insights. They’ll provide regular updates to keep you in the loop on global trends, making them a trusted partner for navigating the choppy waters of international currency exchange.

CurrencyFair is another solid pick for those penny-pinchers looking to minimise costs without compromising on security. Offering competitive rates and a peer-to-peer marketplace, CurrencyFair ensures you’re getting the best rates in town, while also having a user-friendly platform and excellent customer support.

What’s cool is their nifty "Rate Optimizer" tool. This feature automatically finds the best available rate within their peer-to-peer marketplace, ensuring that you get the most out of every exchange, like having your own personal rate hunter!

Let’s not forget about Payoneer, a trusted name in global payments, with a range of features tailored for international businesses. Competitive rates, multiple currency accounts, and a simple robust platform. Payoneer also provides a dedicated support team that assists with any issues you may encounter along the way.

Perhaps the best thing about Payoneer is their integration with popular e-commerce platforms like Amazon, eBay, or Shopify. They’re all about making your life easier for cross-border payments so you can focus on what matters - growing your business.

No introduction needed for this American powerhouse - they’re worldwide online payments system is massive. They’re a go-to for online vendor and auction sites, with their one-click transactions and password memory. PayPal is widely recognized for their top-notch buyer protection and fraud prevention measures, which earned their stripes as one of the most trusted names in online commerce.

Finally, we have HSBC. the British giant that's been around the block a few times. As one of the world's largest banking and financial services institutions, HSBC serves customers worldwide with corporate and investment banking, along with a range of other financial services. Whether you're looking for personal or business features, HSBC has something for everyone.

Oh and keep an eye out for honourable mentions Western Union and Airwallex - they’ve got some great features too.

So, that’s the lineup of top contenders to Revolut, each with its own unique strengths and features. Whether you're after competitive rates, top-notch security, or a wide range of financial services, there's something here for every business's needs.

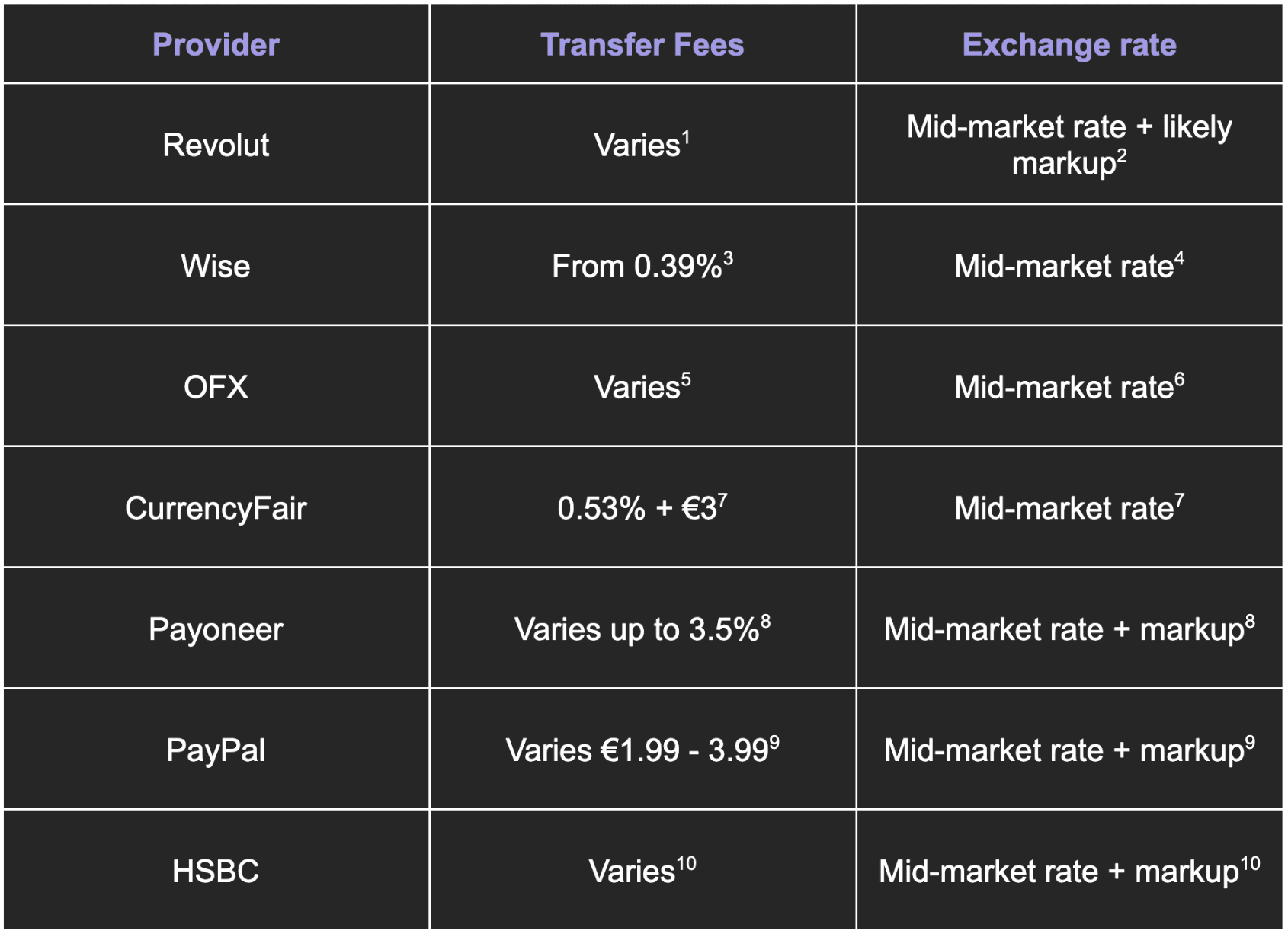

Comparing Costs and Fees of Revolut Alternatives

Ready to make up your mind? Not so fast! Let's talk dough - because delving into the costs and fees is vital before making any big moves. So, we’re breaking down the pricing structures of our top picks to help you make a savvy decision.

Tip: These values were checked in April 2024, so if you’re reading this far in the future, best to look through the sources yourself in case numbers change.

https://wise.com/gb/pricing/send-money?sourceAmount=1000&sourceCcy=GBP&targetCcy=EUR&tab=0

https://www.currencyfair.com/how-it-works/currency-exchange-fees/

https://www.hsbc.co.uk/international/using-your-card-abroad-fees-and-charges-explained/

Best Alternatives to Revolut for Hedging

BUT WAIT! There’s more. Why settle for the basics when you can add an extra layer of protection against currency risks with hedging? If hedging sounds like a priority for your business, then let’s explore some alternatives to Revolut that offer robust hedging options.

Traditional Banks

The big banks, think HSBC, Lloyds, Barclays, you name it. They’ve got teams solely dedicated to FX risk management and hedging services, which means you’re tapping into some serious expertise. Their knowledge and guidance provided by their professionals can be excellent, especially if you’re inexperienced at managing FX risk. Banks also typically offer a buffet of hedging tools tailored to different risk appetites, including forward contracts, options, swaps, and more.

But hold up, there’s a catch: depending on your relationship with them, banks are known for slapping on higher fees and margins on FX transactions and hedging products compared to alternative providers out there. Plus, FX hedging transactions with banks can get pretty time-consuming and complicated. You might find yourself drowning in paperwork and other processes, not exactly a walk in the park for smaller businesses. Their standardised hedging products might also not fully align with your specific risk profile and hedging requirements.

Take a look here to see how we compare to traditional banks.

Forex Brokers

Forex brokers, the middlemen of the currency world. These folks specialise in FX conversion and hedging, and they’re great at beating the bank’s rates. But here’s the thing, if this isn’t your first rodeo, you’ll know that some brokers follow a sneaky business model: They lure you in with killer prices (maybe a loss leader), then gradually, trade by trade, they start inching up those rates. Huh, how’d that happen?

Now, brokers could be your go-to if your FX needs are complex. But remember, with complexity comes a lot of back-and-forth. You'll want dedicated personnel to manage all the details and keep those broker relationships in check. Brokers like Alpha, Corpay, TorFX, Smart Currency Business, Lumon and Universal Partners offer a good selection of services, from spot trades to forward contracts and options.

Specialised Fintech Companies

Last but certainly not least, we have to talk about specialised fintech companies. Companies like Bound (👋), Pangea, Alt21 and Hedgeflows are shaking things up as viable alternatives. These guys are leveraging innovative technology (AKA wizardry) to offer slick, cost-effective solutions that give traditional banks, online exchanges and FX Brokers a run for their money.

Compared to their old-school counterparts, these fintech firms are a breeze to work with. They’re flexible, user-friendly and won’t bleed your wallet dry with sky-high fees. Oh, and did I mention some of them, (wink 😉), even offer next-level hedging solutions for a comprehensive risk minimisation toolkit? Yeah, not bad.

And, there you have it. When it comes to hedging, you've got options. Whether you stick with the old guard or jump on the fintech train, make sure you do your research first. Currency roller coasters mess with everyone’s plans, so it’s important to pick your service with a sharp eye. Figure your own FX and hedging needs, resources and capabilities, and then form your own criteria for assessing FX services. (Yep, you’re allowed to use this as a guide). Signing off!

No opinion given in the material constitutes a recommendation by Bound Rates Limited that any particular transaction or investment strategy is suitable for any specific company or person. Results may and will vary. The information in this publication does not constitute legal, tax or other professional advice from Bound Rates Limited or its affiliates.

Stay up to date with insights

Enhance your finance skills by learning from our network of top industry experts