Transcript

Hey, my name's Luke and I'm part of the go to market team here at Bound. This video is just to explain what you can do with our currency conversion and hedging platform.

So exchange rate swings are very unpredictable and what most tech companies aren't aware of is that you don't need to take whatever the exchange rate is on the day that you need to transfer your money.

I'm going to show you how you can use hedging strategies to optimise how you convert currencies.

Forwarding

…is an easy way to lock exchange rates for your future conversions. You're essentially removing the risk that the rate is going to get worse from the current moment and replacing an unknown future rate with a known one now.

So if you favour planning ahead with certainty over anything else then forwarding will suit you nicely.

Averaging

…is a super simple strategy that smooths out exchange rate volatility. So instead of taking your chances on the jaggedly red line, you're now automatically maintained on the gentle yellow line.

Averaging works by programmatically splitting up your future conversion requirements into many small transactions and just spreads them out over several months.

So if achieving a specific rate is not overly important to you, And you just want to avoid converting at bad times, averaging could be for you.

Ranging

We've spoken with a lot of tech companies that want to try and balance getting a better rate with also having protection in place should the worst case scenario happen. It's normal to feel invincible when rates are in your favor, but as soon as they drop below an important level, panic can set in fast.

So we made a new strategy called ranging. It allows you to set both protective and target guardrails on your future conversions. So you can protect your downside whilst keeping your upside.

This is our onboarding process

…we aim to get everything set up within a week and our customers have loved how quick and straightforward it is.

So I'm going to show you how easy it is to use these strategies on our app.

So here I have an averaging program that say I've got funded in us dollars, but my operational costs are in euros.

Here are all my cash flows over the next 12 months. And the dates I'm going to physically transfer the cash on. I can increase the amounts and decrease the amounts in line with changing business needs, and I can also move the settlement dates out as well. Backwards and forwards.

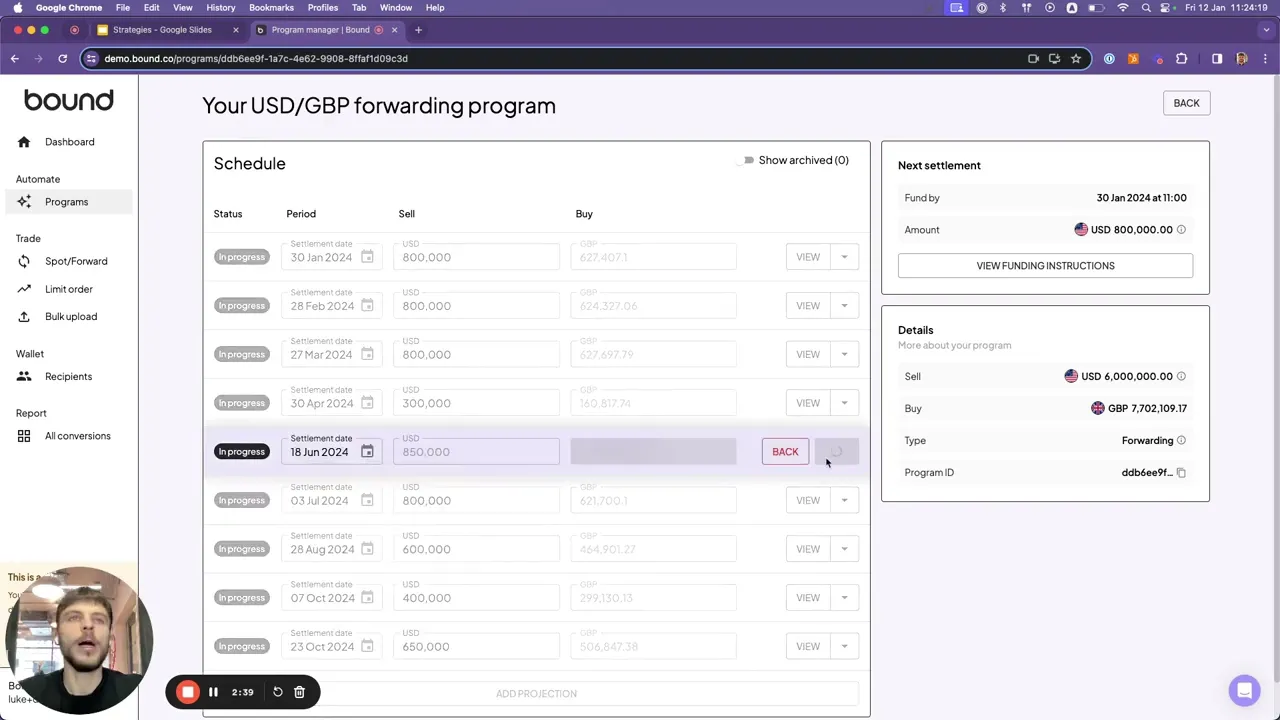

Let's have a look at a forwarding program here. Let's say this is my U S dollar SAS revenue, but I need it in Sterling. Again, I can just click here and push the day out. I'll get a refresh quote, hit save, hit confirm.

And that's all done for me. Exactly the same thing with changing the amount if say I've got a little bit more revenue coming in than I thought. Just simply change that, get a quote, hit confirm.

And everything is reconfigured for me in the background to ensure you don't need to take your chances by converting on the spot anymore.

With the programs feature in our app, you can optimise currency conversions and hedging with these to plan ahead and minimise loss with all the flexibility that you need.

Stay up to date with insights

Enhance your finance skills by learning from our network of top industry experts