China has been the largest exporter of goods in the world since 2009. In 2020, total Chinese exports amounted to $2.591 trillion, with the UK having a share of $66.14 billion of this according to the Department for International Trade. In 2020, according to the same statistics, this figure jumped by 37.3% to $90.84 billion.

The key attractions of China to UK-based importers, as ever, are the low prices and breadth of availability in the field of product manufacture.

While China does offer a great opportunity for UK businesses looking to benefit from overseas production, importing from China does come with various challenges.

In this article, we will run through some of the common problems that UK importers face when importing goods from China and some of the common suggestions on how to get things right.

Supplier Difficulties

Many of the most frequently reported issues are related to dealing with suppliers. In particular, there are recurring themes amongst importers from China of problems with communication and manufacturing quality, and also delays in receiving goods.

Importantly, it is a good idea to make sure that you make every effort to find the right supplier before beginning a relationship with one. Also, it is important to find the right approach to communicating with them and it is important to make a plan about how to approach the issues of delays and quality control.

For many importers, the manufacturing stage of importing products from China presents the biggest challenge. Some suggestions are to go through trading companies or to use suppliers that are specifically geared towards your line of business.

Poor Communication

The barriers presented by language, cultural differences, and differences in forms of negotiation can present a major challenge. As well as getting past the basic issues of language and culture, it is often difficult (particularly for those who are new to it) to understand how to best handle ongoing negotiations about quality control, production timings, and other important issues.

In many cases, there is a need to find the appropriate way for an importer to be able to make their demands clear and to have an ongoing input and level of control over production. In cases where a good level of communication is not achieved, suppliers often lose control of the production process. The result of this can be substandard or incorrect production or delays.

Quality Problems

The delivery of substandard products, problems in quality consistency, and a lack of improvement in quality over time are often the biggest quality challenges that importers face when using Chinese producers. In some particularly bad cases, entire batches of non-conforming or defective products are received in the UK. In many other cases, where quality problems occur, there are quality consistency problems across large orders or initial plans to improve quality standards over time are not achieved.

It is important to make sure that the supplier that you use is able to produce what you want to the standards that you want. The use of an inappropriate manufacturer or a manufacturer with low-quality standards can prove to be troublesome.

Some general pieces of advice are to look at the reputation of the manufacturer, test them to see if they are able to meet your requirements, test them to see if they are aware of UK quality standard requirements, and to define your requirements in a formalised way. It is also a good idea, if it’s possible, to inspect products and to monitor production as it goes ahead.

When it comes to problems in consistency across large orders and failings in quality improvement over time, this is often attributed to poor supplier selection. Where it is not possible to find a way to improve things it may be necessary to find a new supplier.

Delays

It is often said that it is important to expect delays, on top of the normally expected production times, when having goods manufactured in China. This is particularly the case if the product you are ordering is a new product. As well as delays occurring, it is also difficult sometimes to get clear information on what stage things are at in the production process.

Many people say that the best thing to do is just to expect significant delays. Advice differs on how much spare time to leave, but around one month for new orders and two weeks for repeated orders have been given as advised buffer times.

As well as delays in production, it is important to remember that shipping times from China are lengthy (30-40 days on average) and that delays can take place at parts of the process other than in manufacture.

Violation of Intellectual Property Rights

In some cases, producers in China do not pay sufficient attention to intellectual property rights when carrying out production. It is important to make producers aware of the intellectual property laws that exist in the UK and to ensure that production is carried out without any violation of them.

Rising Prices

In recent years there has been a trend of rising prices in Chinese production. As a result, particularly in certain areas, Chinese production is becoming slightly less competitive over time. While this is the case, China is still a very competitive country for the manufacture of a huge range of products and will continue to be so for a long time.

When it comes to agreeing on prices for production, it is important to question rises in price and to make sure that you are really getting a good deal. While prices are on the increase, as a result of China’s increased development, in many cases price increases are just added on by manufacturers. It is a good idea to question the price and to research it in-depth to make sure that you are getting a good deal.

Fluctuating Exchange Rates

One of the biggest issues for UK-based importers that import from China and pay their suppliers in a foreign currency (whether that be the US dollar or Chinese Renminbi) is fluctuating exchange rates.

Known as currency risk or foreign exchange risk, the risk posed to businesses that deal in foreign currencies by the possibility of an unfavourable change to exchange rates is a serious issue. It is thought that for UK-based SMEs that trade in foreign currencies, the average annual loss as a result of changes to the exchange rate is around £70,000.

While it may seem that, with exchange rates going up and down, there should be a net equal over time, this is not the case. Where companies leave themselves vulnerable to exchange rate changes, they tend to lose out. This is particularly true in highly volatile currencies. With the Chinese Renminbi (RMB) having a history of a high level of volatility and there also being a recent trend towards a rise in the value of RMB against the pound sterling and the dollar, currency risk may be a serious issue in the future when importing from China.

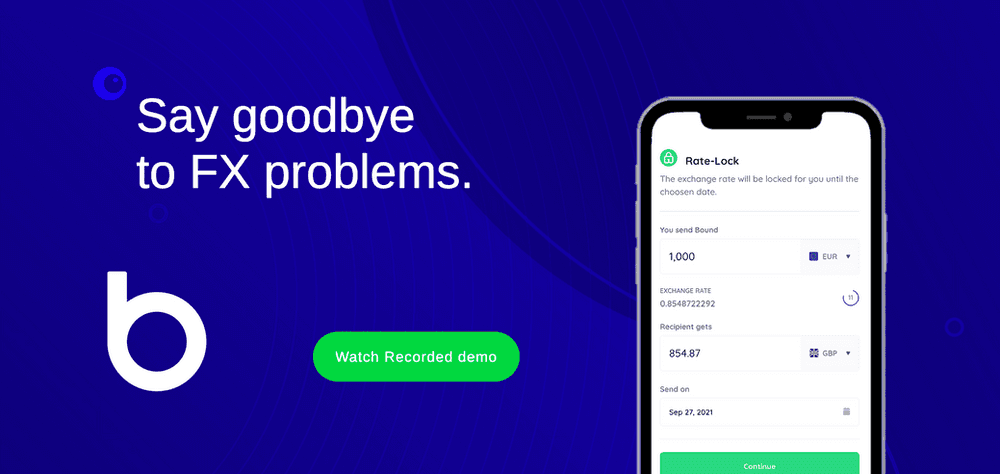

Bound specialises in providing the means by which UK importers of all sizes can protect themselves against changes to the exchange rate. By using Bound’s services to hedge against the risk of detrimental changes to the exchange rate, companies that import goods from China (or any other country) are able to operate with complete certainty about future exchange rates that they will receive. This is done at minimal cost and is a service that can be used by companies of all sizes.

Rules and Regulations

The rules and regulations associated with doing business in China add additional costs and can also cause delays.

UK Import Laws

It is important to be fully aware of all the UK import laws that apply to any goods that you import from China. While it is important that every importer makes sure they are fully aware of the specific individual requirements that they will have to meet, some of the most important things to do are…

Make Sure You Have All the Right Documentation

Among other things, it will be necessary to have an EORI number for your business and to find out the relevant commodity codes for the products that you are importing. Commodity codes help with identifying the products that you import and ensuring the right payments are made for them.

Some goods will require an import license and it is a good idea to check whether you need to apply for one.

Make Sure That Your Shipment is Correctly Labelled

Your shipment labeling should include details of…

The sender and receiver of the goods

The quantity and value of the goods

The commodity codes, as previously mentioned

A detailed description of your items

Make Sure That You Pay Tax on Your Products

In most cases, it will be necessary to pay VAT and duty on products that you import, with the amount of duty that you pay depending on what it is that you import.

UK Product Rules and Regulations

As well as making sure that you meet the UK importing laws, it is important to make sure that the product you import meets UK product rules and regulations.

As we mentioned earlier, it is important to make sure that your supplier is aware of what they are and that they are instructed to produce goods that meet the necessary requirements. As well as making every effort to ensure that your producers manufacture your products to the right standard, it is also a good idea to check that this has been done when you receive them in the UK.

Stay up to date with insights

Enhance your finance skills by learning from our network of top industry experts