Any business which conducts trade in foreign currencies, as many people who read this will be aware, is exposed to currency risk. Currency risk is the risk that changes to the exchange rate will cause a business that trades in foreign currencies to lose money. Exchange rates, particularly for the British pound since the Brexit vote, can be volatile. Where a business leaves itself vulnerable to exchange rate changes, adverse movements can cause money to be lost.

The three types of currency risk are known as economic risk, translation risk, and transaction risk. This article deals with transaction risk. Economic risk is the risk that a company’s market value will be reduced due to a change in exchange rates. Translation risk is the risk a company faces when it has assets listed, which are denoted in a foreign currency.

Transaction risk, on the other hand, is a common form of risk and is what a company faces when it completes a transaction in a foreign currency. Between the time that a transaction is agreed to, whether that be a sale or purchase, and money changes hands, exchange rates can change. If exchange rates change adversely, a company will lose money.

In this article, we will run through the many ways of dealing with transaction risk, starting with two of the most common methods.

Common Currency Hedging Strategies

The methods by which companies can protect themselves against currency risk are otherwise known as currency risk management strategies or FX hedging strategies. Two of the most common methods of protecting against transaction risk are forward trades and option trades.

Hedging Against Currency Risk with a Forward Trade

With a forward trade, a company that is due to complete a transaction in a foreign currency can set exactly what exchange rate it receives at a future date. With a forward trade, a company will not be at any risk from exchange rate changes. On top of this, there is no fee (or premium as it is referred to with option trades) for taking out a forward trade.

As a simple example, a company that has agreed to purchase materials in a foreign currency from a company based overseas can take out a forward trade to protect itself against exchange rate changes. After the order has been agreed, the company can approach a forward trade provider to take out a forward trade. When the time comes to actually make the payment, they can use the forward trade to convert their domestic currency into the relevant foreign currency to make the payment. The forward trade will provide certainty about how much the purchase will cost as any changes to the current market exchange rate will not have any effect.

The situation is exactly the same with companies that make a sale in a foreign currency. The exchange rate that a company receives for a sale that it has agreed to in a foreign currency can be set for the future.

One downside to forward trades is that there is a commitment to complete the exchange of currencies once it has been agreed to. This is where option trades come in.

Hedging Against Currency Risk with an Option Trade

When a company hedges transaction risk with an option trade, it can also set an exchange rate for a future date, similar to a forward trade. This provides security about the minimum exchange rate that they can receive. However, there is no contractual commitment to complete the exchange of currencies. If the company wants to, it has the option of not using the option trade.

One advantage which arises from this is that, where a company does not wish to take a forward trade because there is a risk that a transaction will not actually take place, they will not be committed to exchanging currencies. However, option trades also have an added benefit.

The added benefit is that, with an option trade, if exchange rates move favourably between the time that a transaction is agreed to and it takes place, the company can choose not to use the option trade. In this situation, they just exchange currencies at the spot rate (current market exchange rate) instead and benefit by doing so. While there is a premium paid for taking out an option trade, favourable changes to the exchange rate can still be taken advantage of. As a result, a company that has one can benefit from favourable changes to the exchange rate.

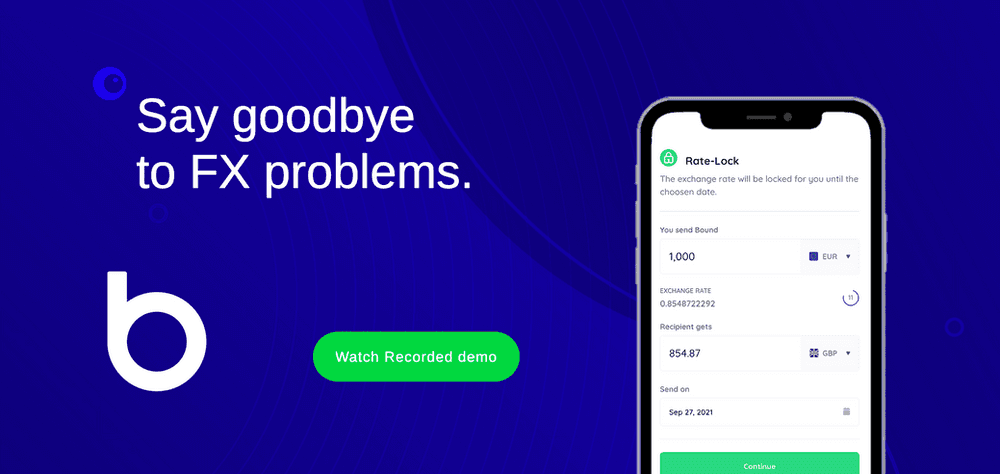

Use the Bound Platform

Forward trades, option trades, and spot trades are all available on the Bound platform. Bound exist to make it easy for businesses that trade in foreign currencies to eliminate the risk they face from exchange rate changes. If you are interested in whether a forward trade or an option trade could help your business to manage currency risk, then go to the platform and have a more in-depth look at how it works.

Not all businesses use forward trades or option trades when they are completing transactions in foreign currencies. Read on to find out how other transaction risk hedging strategies work.

Other Currency Hedging Strategies

Here are some other methods by which companies that trade in foreign currencies reduce the risk they face from changes to the exchange rate.

Not Doing Anything

One approach which is worth mentioning is not doing anything. This is an approach that many businesses, particularly UK-based small and medium-sized enterprises (SMEs) take. The logic is that while exchange rates may move unfavourably one moment, the next they may move favourably. The hope is that, by doing nothing over a series of transactions, a net-zero balance will be achieved.

The problem with this is approach is that it has been found not to work. Unfortunately, most businesses that take this approach find that they lose out overall. To illustrate the danger of currency risk, a report issued in 2017 found that the average annual loss arising from exchange rate fluctuations, for UK-based SMEs that trade in foreign currencies, is £70,000.

As well as there is a general risk of loss over multiple transactions, there are also certain circumstances in which a company may wish to reduce the risk from a particular transaction. One example is an isolated large transaction in a foreign currency. If a company is carrying out a single large transaction in a foreign currency, it may wish to hedge the risk it faces from that transaction as it is a notably risky one.

Hedging Currency Risk with Futures Contracts

Hedging against transaction risk with a futures contract is similar to using forward trade. If a company buys a futures contract, it will be able to rely on the same agreement that it will have with a forward trade. That is to exchange currencies at a set rate in the future. They will be able to fix the exchange rate that they receive at a future date and use this rate when the time comes to complete a transaction.

The difference with futures contracts is that they are sold on an exchange with standardised amounts of currency to exchange and standardised dates by which they must be settled. Forward trades, on the other hand, are more bespoke deals made between a company and a forward trade provider.

Hedging Using the Money Markets

Money market hedges can be confusing, but the basic idea behind them is simple. With a money market hedge, a company uses the money markets to either lend or borrow money in a foreign currency. The money is either lent or borrowed at a certain time in preparation for a future transaction. By lending or borrowing in preparation for a future time, any changes to the exchange rate which take place before the transaction is completed do not have an effect.

When the time comes to complete the transaction, if it is a purchase, money lent to the money markets can be used to complete the transaction. If it is a receipt of money, the receipt can be used to satisfy what was borrowed from the money markets.

Limit Orders

Limit orders can be used by companies that make purchases in foreign currencies. With a limit order, a company can set the ideal exchange rate at which it would like to buy a foreign currency. They can then instruct a payment provider to purchase a set amount of foreign currency when that exchange rate is reached. The foreign currency that they obtain can then be used to make purchases at the time it is obtained.

Limit orders can be useful to businesses that need to make payments in foreign currencies but are not confined to deadlines. The time at which they make payments will be dictated by exchange rates. As a result of this, they are usually a poor choice for a business that faces transaction risk as there will be no guarantee that exchange rates will move favourably enough to trigger an order.

Risk Sharing Agreements

With a risk-sharing agreement, a company that is doing business in a foreign currency with another business can enter into a risk-sharing agreement. With a risk-sharing agreement, the two companies will agree to split any changes into currency amounts that arise as a result of changes to the exchange rate.

Matching

With matching, a company that both receives and pays out money in a foreign currency can match transactions together to avoid exchanging money through the exchange markets. Any money which is received in the foreign currency is used to satisfy payments that the company needs to make in the same foreign currency. As such, for most of the value of a company’s trading in the foreign currency, the need to exchange currencies is avoided.

Using Domestic Currency

A simple way to avoid transaction risk is for a business to only trade in its domestic currency. While this completely removes the risk that the company faces itself, it pushes the risk entirely onto the party with which it is trading overseas.

Price Variation

Price variation is a simple method that exporters can use to reduce transaction risk when selling to overseas buyers. The aim is to change the price according to how exchange rates are expected to change between the time a sale is agreed and payment is received. However, exchange rates are unpredictable and this is unpredictability is actually why most companies have a need to find a straightforward and reliable method of managing currency risk.

Leading and Lagging

With leading and lagging, a company will look to either make or receive payments at a time when exchange rates are favourable. For example, this can be done by encouraging buyers to make payments by offering a discount at a favourable time. Or, simply, by withholding payment until a favourable time. This method does, however, require management and does not remove the risk that exchange rates will not move favourably enough.

Stay up to date with insights

Enhance your finance skills by learning from our network of top industry experts