One of my first lessons in hedging

When I first started working in fintech, over a decade ago, I saw these videos on CME. I think the page might have changed a little in the past 10 years, but I think the videos are the same. Haha.

I didn’t really understand hedging at the time, but this was one of my first lessons on how trading and capital markets work.

How I think of the market structure

Today, I generally think of the market in 3 big segments.

People who have risk, but don’t want it - hedgers

I’m an American company, but we have European customers that pay us in EUR. If the EUR falls, then my revenue falls and I lose money! I have exposure to the EUR that I really don’t want. I didn’t sign up European customers to place a currency bet. Help!.

I’m a UK company with a lot of European staff. If the EUR strengthens, my payroll costs go up and I lose money! I didn’t hire European staff because I was predicting a weakening EUR. I just wanted to hire good people and I found them there. Help!

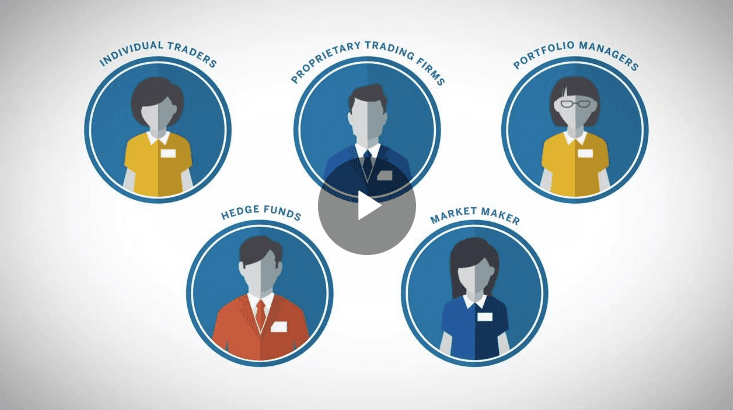

Capital market and financial market participants that make everything work

These roles are varied and different, but as a group they play the broad role of helping buyers and sellers find each other at efficient prices. Some examples of these are:

Bound

Banks

Brokers

Trading houses

Liquidity providers

Market makers

Exchanges

People who don’t have exposure, but want it - investors/speculators

I’m a hedge fund manager at a huge global hedge fund. My analysts and I think the EUR is going to fall over the next 6 months. I want exposure to a falling EUR during that time.

I’ve just quit my job to day-trade currencies and I found an online app that will give me 300x leverage. This EUR graph is looking about ready to pop! Let’s make some fast money! (or lose all my money fast.. haha).

What role do you want to play?

Anytime you have future cash flows in foreign currencies without corresponding hedges, you’re exposed to exchange rate movements between now and the time of that future cash flow.

By doing nothing with future foreign cash flows, you’re running currency exposure similar to a currency investor/speculator, albeit for a different reason.

Are you purposefully trying to take EUR risk?

Most of our customers, before using Bound, were taking significant currency risk inadvertently.

They weren’t doing this because they wanted to run a currency investing business from inside the finance department of their tech company.

The opposite was true. They didn’t want currency risk, but they weren’t familiar with or have access to tools to effectively manage their currency exposure.

Don’t let currency risk hitch a ride into your finances each time you sign up a foreign customer or hire a foreign employee.

Stay up to date with insights

Enhance your finance skills by learning from our network of top industry experts