Cognitive biases are sneaky. They mess with your decision-making – without you even realising it. Whether it’s deciding what to have for lunch, or how best to manage your FX risk, your brain is constantly taking shortcuts, often based on past experiences.

Yes, we all love the easy route now and again. But these mental detours can lead you down the wrong path, especially when you’re under pressure.

Are you thinking straight?

Luckily for you (and us), neuroscientist and firefighter, Dr Sabrina Cohen-Hatton, gave some hot tips on how to spot and manage cognitive bias at TreasurySpring’s recent Tea & Treasury event.

Two traps she taught us to watch out for are:

Confirmation bias: seeking what you want to believe

You’ve probably heard of this one. It’s when you subconsciously look for information that confirms what you already think. Take a CEO who strongly believes that acquiring a particular company will lead to significant future growth for the business. As a result, they focus heavily on positive forecasts and optimistic valuation reports, while downplaying or ignoring risks, as well as warnings from analysts. This is confirmation bias in action.

So, next time you choose which FX forecasters to believe (don’t even get us started on that!), maybe think about whether you’re picking them based on your own idea of where the market is heading rather than objective factors.

The mere exposure effect: playing it safe (maybe too safe?)

Ever been tempted to buy the same tech brand again and again, just because it’s what you always do? That’s the mere exposure effect – a tendency for people to develop a preference for things simply because they are familiar with them. What you already know feels safe.

But in FX, using the same hedging strategy on autopilot, or always choosing to have no hedging strategy at all, could mean you’re missing opportunities to manage your risk smarter.

Beating the bias

Can you really outthink yourself to make better decisions, though?

Short answer: yes, you totally can – well, most of the time! Once you’re aware of the biases at play, you can hack your brain’s shortcuts and stop letting them hijack your common sense.

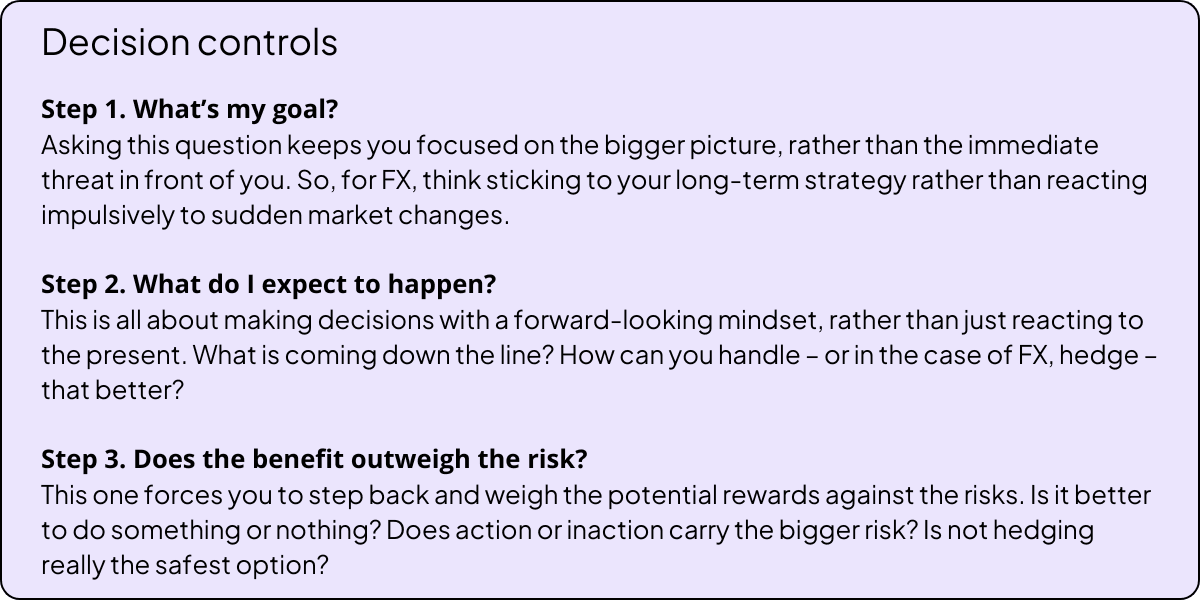

Dr Cohen-Hatton shared a super simple but powerful framework that firefighters use called ‘decision controls.’ It’s a mental checklist that helps avoid snap, emotional choices. (And it could be handy for reducing bias in your FX strategy too).

Restoring logic through FX tech

Let’s take this thinking a step further, though. Why not take bias out of the equation by handing over the heavy lifting to tech?

Sounds scary, but it’s actually pretty simple. So, instead of second-guessing yourself, you automate the process (well, get tech to automate it for you!).

Forward contracts, for instance, can easily be automated based on specific business needs or market triggers, meaning you consistently lock in rates without reacting emotionally to short-term market shifts.

Automated strategies can also be set up to execute regular currency conversions at set intervals, spreading risk over time. This removes the temptation to time the market, which can lead to decisions clouded by fear or optimism. Been there, done that…

Bottom line: automated FX hedging strategies can help treasurers and CFOs make more consistent and objective decisions by avoiding the emotional trap of reacting to market swings. That means sticking to your long-term FX goals and getting more predictable foreign cash flows, with a lot less hassle.

It doesn’t mean losing control over your hedging decisions. It’s just about making sure your strategy is driven by consistency and logic – not bias.

Want to start hedging smarter, not harder? Speak to one of our experts

No opinion given in the material constitutes a recommendation by Bound Rates Limited that any particular transaction or investment strategy is suitable for any specific company or person. Results may and will vary. The information in this publication does not constitute legal, tax or other professional advice from Bound Rates Limited or its affiliates.

Stay up to date with insights

Enhance your finance skills by learning from our network of top industry experts