Small and medium-sized enterprises (SMEs) are the backbone of the British economy. SMEs make up 99% of all businesses in the UK.

As global patterns of trade change, it's become easier for SMEs to trade internationally. Because of this many companies jumped at this chance to grow as well. While trading internationally brings many opportunities, it also means exploring newer challenges. One of these challenges includes exchange rates and currency risks.

Currency risk represents the risk a company's profits have with frequently fluctuating exchange rates. The more dynamic rates are the riskier it is for businesses to trade currencies. With more and more British businesses trading internationally, their exposure to currency market risks becomes a growing problem.

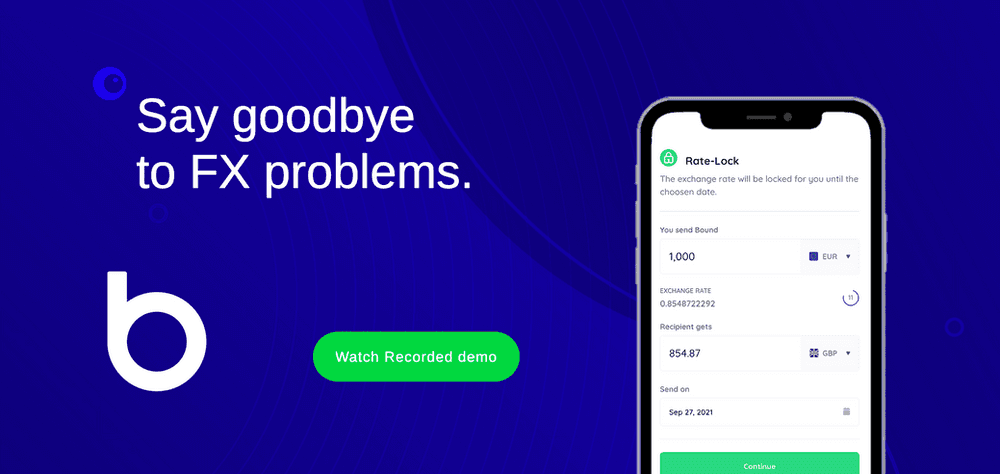

Simple currency exchange platforms like Bound exist to make it easy for UK-based SMEs to manage their risks. If dealt with effectively, overcoming these risks can put businesses ahead of their competition.

How Does Currency Risk Work?

The simplest form of currency risk is transaction risk. This happens when a time delay occurs between when a company places or receives an order and when the corresponding transaction actually takes place.

Let's take for example, an exporter who accepts an order with a payment expected at a much later date. This delay between order and actual money coming in exposes them to currency risk.

Exchange rates may change against the company's favor during the period between the agreed order and when the company receives the corresponding payment.

If this happens, the payment they receive converts to a lesser amount in their own currency than it would have been at the time of the sale.

Transaction risk goes the same for companies that buy materials and services abroad. The only difference is when it's time to pay for the agreed purchase, it may end up costing more than expected.

While it is true that exchange rates can change for the better as well, companies that do nothing about the problem usually incur more net losses. One major report found that, on average, SMEs that trade in foreign currencies lose £70,000 each year because of fluctuating exchange rates.

What Can SMEs Do About It?

Two popular ways of eliminating currency risk are forward and option trades. Fortune 500 and other big businesses have been using forward and option trades for a very long time now. Yet, far fewer SMEs have taken them up because they're either misinformed or have no idea what these are.

Forward and option trades are simple contractual agreements. With forward trades, a business can convert foreign currencies at fixed exchange rates in the future. Making this a great way to protect profits against highly volatile markets. Let me show you how they work:

Forward Trades

With a forward trade, businesses can use FX trade providers to fix exchange rates for the future. They agree to exchange the amount of currency the business needs on or before a future date. Back then, only banks and brokers could do these except now, other providers like FX companies can do the same too. If not, even better!

These currency exchange companies usually act as a middleman for both businesses. Let's say a British manufacturing company wants to order materials from a Chinese supplier. If they want to make the payment in a future time, probably after their order arrives. They can use a forward trade to protect theirs and their supplier's interests.

Their chosen FX trade provider will then agree to exchange British pounds for Chinese yuan at their desired rate in the future. Both businesses now know how much in British pounds the UK business needs to pay when the time comes. Even if current exchange rates (known as spot rates) change these fixed rates won't change at all.

The same goes for companies that receive payments in foreign currencies. Any foreign currency converts back into British pounds at the pre-agreed rate. Forward trades are basically a win-win for both parties!

How About Option Trades?

Option trades are a bit more complex than forward trades. Yet, they're totally possible and still are easy for any business to do. For many businesses, option trades are more attractive than forward trades.

They take away one of the downsides forward trades have which is being contractually obliged to complete the trade. Once a forward trade is set, the payor company must pay to the pre-agreed rates. Now usually, this isn't a problem since both businesses have agreed to it already. But, what if rates go significantly lower on the date? The payor company could save a lot on the transaction and still meet the agreed prices with the recipient company. With a forward trade, there's no way you can change that and trade at lower prices.

Option trades let you lock in exchange rates without having to buy into it right now. Instead, you can exchange currencies at the spot rate (the current market rate). Giving way to being able to opt-out of the trade for one that costs less. Plus, even if prices don't go cheaper in the future, option trades can stick to a favorable fixed rate. You know, just in case.

How Serious are Currency Risks to SMEs?

Small and midsize businesses in the UK lose tens and thousands of profits and potential reinvestment. As said earlier, they lose an average of £70,000 per year because of exchange rate fluctuations. Considering 99% of the UK are SMEs, that's a very alarming figure.

Companies that handle transactions in foreign currencies regularly should be well aware of how severe this problem is. A Bibby Financial Services report in 2017 found that currency volatility is the biggest problem for 51% of importing SMEs and 34% of exporting SMEs in the UK. Much more today, where this problem is increasingly relevant.

Many experts believe that it is the single biggest challenge faced by SMEs that trade internationally. The extent of the problem has come to light as more companies have moved towards trading in foreign currencies. More of them raised their concerns following the Brexit vote which made this problem worse.

SMEs are significantly more affected in comparison to big businesses. Even with recent improvements, currency risk management is still misunderstood and underused by SMEs. Also, the time and cost involved to do it make it a huge barrier of entry to try out.

Bound wants to help SMEs deal with this problem by making a currency risk management tool that's easy to use and understand. This way we can help ease the seemingly difficult and intimidating stigma behind it.

You Don't Have Manage Currency Risk Alone

One of the main reasons why currency risk management is not common for many small and midsize businesses in the UK is how poorly educated it is.

Articles and learning resources like this help clear up confusion and misconceptions about the currency market. Including helpful practices such as forward trades and option trades.

The truth is there are a couple of places online that help businesses, traders, and hedgers like you understand the market better. They're just not that abundant compared to other things. These resources help people understand the process of how to do forward trades and option trades. And also, other forms of currency risk management. Its scarcity makes it expensive and time-consuming to master and make profitable.

With Bound, we not only help deliver reliable information about the currency market. We also provide the simplest tools businesses can use to reduce their exposure to currency risks. Any business can easily set up an account with us in 30 mins.

They can make both forward and option trades in minutes on the platform including spot trades. All done with complete transparency, zero hassle, and no hidden fees. Bound also has a team of experts ready to help you out through the platform and when you make a trade.

Stay up to date with insights

Enhance your finance skills by learning from our network of top industry experts