Before we get to comparing forward and option trades, let me introduce you to currency risks and what these two are.

If you already know what forward and option trades are, you can click here and skip right to it.

Now...

Exchange rate fluctuations affect SMEs differently compared to larger companies. SMEs often suffer heavier losses because of the lack of knowledge and skill in FX risk management. It's been possible for large companies to weather through such risks as its more accessible for them. We want to help change that.

This particular area of risk management can cost a lot of time and money just to make it happen. Or so they thought...

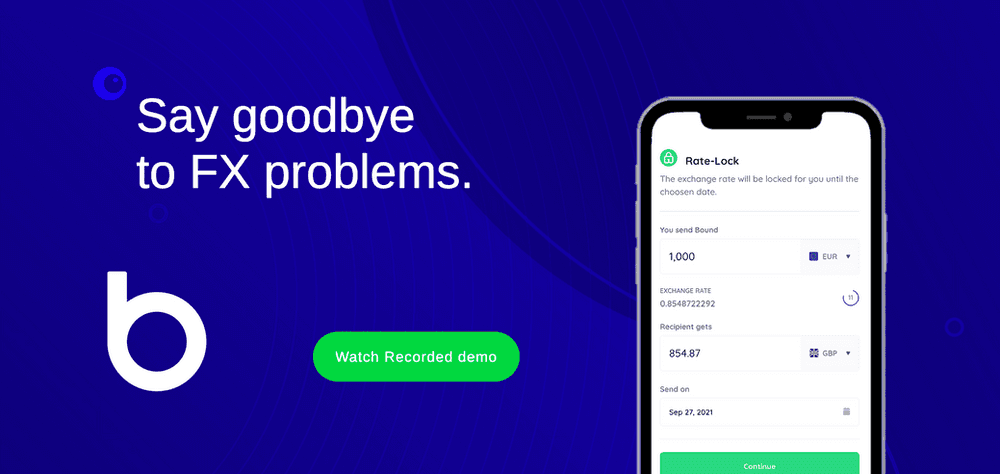

Many also think FX risk management is too complicated to even consider as effective. That's a big misconception. There's a lot of confusion behind how to protect businesses from exchange rate fluctuations. Besides brokers and banks, there are easy-to-use providers like Bound that already simplify FX hedging. Plus, there are tons of free and paid resources available to find out just enough to get good at it. Just like this one!

So, what are forward trades and option trades? How are they used? And, why should I know about them?

Because of Currency Risks…

When businesses make foreign transactions, they expose themselves to currency risk (AKA unpredictable exchange rate changes.) These hard-to-foresee changes can be both profitable and costly. Most of the time, it's costly.

Sending and receiving money from a different country is challenging. Businesses have to deal with different currencies and need to change them. A common form of currency risk is transaction risk. This is a kind of risk that happens between the date when businesses make a transaction and when it will actually take place. Especially for businesses that exchange goods and services internationally, recognizing and avoiding this risk is very important. It's an expensive risk to ignore and just let be.

So, how can a business deal with such risk?

How Forward and Option Trades Work

Forward and option trades are two of the most useful ways to manage FX risk. Businesses that transact with foreign currencies often like importers, exporters, and agencies benefit a lot from both. Even individuals like traders and freelancers. Both forward and option trades allow global businesses to secure exchange rates in the future. Because of how volatile these rates can be, there is a growing need for guaranteed fixed prices. These trades let people do exactly just that. They may work differently but they offer businesses a similar sense of security.

How Do Forward Trades Work

Forward trades are contractual agreements that lock in an exchange rate for a future date. No matter what the current rates will be on that date. For example, if 1 EUR costs a UK business 0.85 GBP to convert today and they make a forward trade for a date 3 months later. Those conversion rates won't change even if 1 EUR will cost the business 0.90 GBP in the future. If in total that transaction costs them £85,000 on the day they made the sale, it'll stay that way even if prices in the future cost £90,000.

They make these agreements when they want to buy or sell in a foreign currency in advance. Forward trades lock the exchange rate until they complete the transaction. By doing so, they avoid getting affected by the changes in the currency market. For the other end, these trades are also favourable for them as the payor business needs to pay the exact amount stated on the trade on the day. Basically, the sender pays without the price increase and the receiver gets their money on time and in full.

Forward trades are simple and give businesses certainty on what the exchange rates will be during the transaction.

But, the same goes if exchange rates will cost them £80,000. They've already agreed to £85K and they must pay for that amount even if prices got lower. So, what if that's the case? Or if something similar happens like the deal not going through. Is there an alternative that doesn't put you in a position where "you must pay" that amount? There are—option trades.

Okay, What About Option Trades?

With an option trade, a business can make the same agreement. Fixed exchange rates on this date at this amount. Handshakes exchanged. Heads nod in agreement. The certainty is still there. The only difference is the business that makes the option trade is no longer obliged to pay that amount if ever they wish not to do so.

As the name suggests, they have the option not to follow through with it.

When the time comes to transact, they have the option to go through with it or not.

If exchange rates in the future don't go in their favour, the option trade can still exchange currencies for them with rates from the past.

But, if more favourable changes arise or issues occur, they can put off the option trade. They can now either trade with current prices or cancel the deal they've made.

Let's go back to the £85,000 example. If exchange rates in the future go up to cost £90,000 at current spot rates, they can continue with the transaction even with just the agreed £85K. Because the exchange rates got fixed beforehand. Now, if ever it gets cheaper and costs only £80,000. The business can cancel the option trade and spot trade with a much better exchange rate.

Why? Because with option trades, you're not obligated to pay with the pre-agreed prices. They're pretty useful in speculative situations. If the transaction doesn't go ahead, there's no contract forcing you to pay what you agreed upon.

It's clear that a lot of people will think option trades are better than forwards. However, the latter would not exist if there was no specific use for it. It's best for situations when the option to cancel is not favourable for both parties.

What Makes Them Different?

The key difference between a forward trade and an option trade is a contractual agreement. Forward trades have one while option trades have none. Forwards provide security without the flexibility. The latter tends to have both. Like anything that’s got a little extra with it comes a slightly higher price. This higher cost behind it reflects the lesser earning potential for the provider of the goods/services.

So, How Much More Do They Cost?

Forward trades do not come with an upfront cost. When you take out an option trade, you pay what is known as a premium.

Forward Rates

Exchange rates offered for forward trades are what's known as forward rates. They are pretty much different from the current exchange rate. Providers calculate these once they take into account interest rates for both exchanged currencies. This makes it fair for them to exchange at the expected rate in the future. Because these two currencies will have different interest rates, these will affect their values in relation to each other.

It's easy to think forward rates provide profits for the provider. Yet, this is not the case. While the provider does take profit, these are already accounted for the same way they charge for spot trades. They only do it right after they calculate forward trades.

Option Rates

Okay now, option trades, on the other hand, have an upfront payment called a premium. The exact pricing system behind it can get complicated. But, it is essentially a forward trade with the additional premium. In some cases, future exchange rates offered by option trades are the same as a forward's.

They calculate the premium on top of this. For the pricing, they take into consideration the volatility of both currencies and the term length of the trade. In short, how often do they change, and how long does this trade need to last.

One provider will give a different rate compared to another. So, always check their forward rates and premiums. Although that can be a hassle. So, if you want to do things all together in one place, Bound lets you do that. You can sign up for free and try it out.

Are There Other Ways?

Of course, there are alternatives to forward and option trades. While they're the ones most commonly used, there are other ways to protect a business from currency risk. Other existing methods include money market hedges, leading and lagging, currency swaps, and price variation.

The simplicity offered by forward and option trades makes them the most favourable. You can also try out future contracts.

What are Futures Contracts?

Futures contracts are like forward trades. With a futures contract, a business gets in an agreement with the contract seller to exchange a set amount of currency and rate before a future date. The difference is that they are not tailor-made agreements. Any specific transaction needs will be out of the business' control. Everything is up to the contract seller or the provider. These are mostly sold in an exchange with standardised amounts of currency and maturation dates. They can sometimes be a less convenient choice but also less risky.

If you want fixed exchange rates in the future, you can use both forward trades and option trades to help you make that happen. Although forwards cost less than option trades, options tend to be more flexible minus the obligation. Still, both offer security compared to converting without an effective FX risk management strategy.

Going with the flow in the currency markets may send you falling down a huge waterfall-like net loss. With forward and option trades, you can get ahead of the river. And land in a desirable spot where your transaction is safe.

If you don’t know how to steer your transactions to the right spot with FX hedging, Bound can do it for you. You can watch a recorded demo of how that works here. If you want to find out more, check out more blogs by us like this.

Stay up to date with insights

Enhance your finance skills by learning from our network of top industry experts