The United Nations reported that between 2005 and 2017 the global volume of international trade increased from $12.5 trillion to $22.5 trillion. As the power of the internet has expanded and as it has become easier to move goods between countries, more and more businesses (including UK-based SMEs) have taken the opportunity to take part in this increase in international trade.

For businesses that previously only traded domestically, having the ability to trade internationally has given them a huge opportunity for growth. However, as people who are involved in importing or exporting will know, doing business internationally brings a huge number of challenges.

From the evidence of one recent important study and from anecdotal evidence, these are the main challenges faced by UK-based SMEs that import and export from the UK…

Currency Risk

Surprisingly, many UK firms that import and export now report that currency risk is either the biggest or one of the biggest challenges that they face.

For those who are unfamiliar with the term, currency risk (or foreign exchange risk as it’s otherwise known) is the risk that a company will lose money as a result of a change to exchange rates. A simple example is when a business agrees to a sale in a foreign currency for which payment will be received later in time. In the intervening period, exchange rates may change unfavourably causing a loss of money. This form of currency risk is known as transaction risk and applies to purchases made in foreign currencies as well.

As well as transaction risk, there are other forms of currency risk and a number of ways in which businesses can be affected by the exchange rates.

How Bad a Problem is Currency Risk?

In one study it was found that around a third of UK-based SMEs that export and half which import say that currency volatility is the biggest problem that they face. Overall, in this study, currency volatility was by far the biggest challenge that the businesses questioned faced.

Why is it Such a Problem?

Many agree that a major part of the reason for this is the increase in volatility of the British pound following the Brexit vote. One particularly volatile exchange rate has been that between the British pound and the euro. With a huge amount of the UK importing and exporting happening with Europe, this volatility in the exchange rate has caused a significant problem. In many instances, currency volatility has caused significant losses of money.

It should be pointed out that currency volatility is always a problem for companies that do business between currency zones and this is not a recent phenomenon. While the recent volatility in the British pound has exacerbated the problem, it is something that businesses have had to deal with for a long time.

One issue may be that many companies which trade internationally nowadays are smaller in size than they used to be. Traditionally it has been easier for larger businesses to protect themselves from currency risk. As smaller businesses have begun trading internationally, more have found that traditional avenues of currency risk management have been closed to them. This has caused an increase in attention being drawn to the issue.

One piece of good news for smaller businesses that face currency risk is that nowadays they are now more easily able to access resources that help to deal with currency risk.

Red Tape

In the same survey previously mentioned, only around 20% of exporters and 10% of importers said that managing issues of red tape, such as duty, VAT, export licenses, customs declarations, and proof of export are the biggest problems they face.

The extent to which red tape is a problem depends quite heavily on where exports are being sent or imports are coming from. It may be that the reported low level of trouble from the issue of red tape and administration may have been due to the fact that many countries were doing business in the EU. Up until then few changes to the rules had been announced as a result of Brexit.

Since then, more friction has been seen when trading with the EU and it may be that the amount of red tape faced by British businesses which trade with the EU increases in the future. If smooth trade cannot be performed with the EU, this may become a more significant problem for many businesses.

Logistics

Going back to the previously mentioned study again, 16% of exporters and 14% of importers say that logistics are the biggest problem they face.

Logistical arrangements, such as transportation and storage of goods are time-consuming in most businesses and this is particularly true when doing business in countries with unfamiliar systems. Time invested in this can be costly and many businesses outsource their logistics as a result when dealing with foreign systems.

Other Issues that Importers and Exporters Face

Other key problems that SMEs from the UK that import and export face are as follows:

Customs requirements

Language barriers

Costs associated with doing business

Cultural customs

The handling of international payments

Delays in receiving payments and issues with pursuing debt

Finding reliable suppliers and maintaining good relations

Managing working with different time zones

What Goods Do We Export?

For the year 2020, total exports of goods and services from the UK totaled £601 billion. In the year 2020 to 2021, some of the biggest exports from the UK were in the commodities of machinery and transport equipment, chemicals, materials, food and live animals, and fuels.

To be more specific, the UK is a major exporter of cars, crude oil, pharmaceuticals, aircraft parts, alcohol, jewelry, vehicle parts, and gas turbines, amongst other things.

Where are the Top Destinations for UK Exports?

The top ten export destinations for UK based SMEs are:

The United States

Germany

France

Ireland

China

The Netherlands

Australia

Spain

Italy

India

It is worth noting that half of the UK’s top twenty export destinations are within the EU and the EU is home to three of our top five export destinations.

What Goods Do We Import?

In the year 2020, imports of goods and services to the UK totaled £597 billion. Again, the UK imports similar goods by commodity as it exports.

To be specific about the kind of goods and services that the UK imports, we are big importers of gems and precious metals, machinery (including computers), vehicles, electrical machinery and equipment, mineral fuels, pharmaceuticals, optical, technical, and medical apparatus, plastics, and clothing.

Where are the Top Destinations for UK Imports?

The top ten import destinations for UK based SMEs are:

China

Germany

The United States

Italy

France

The Netherlands

India

Denmark

Japan

Spain

Again, EU countries represent a large proportion of the UK’s import destinations, with over half of the top twenty import destinations being EU countries.

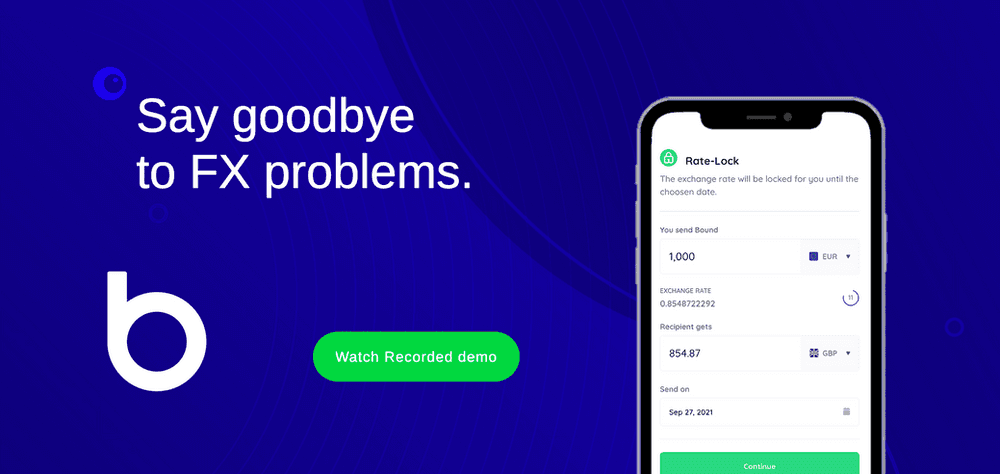

What Does Bound Do?

Bound specialises in helping UK-based SMEs deal with the issue of currency risk. We help businesses to control their currency risk by providing ways that they can fix exchange rates over periods of time.

The services which Bound provides have traditionally been provided by currency brokers or banks. However, dealing with currency brokers and banks can be time-consuming and expensive. Bound provides an online platform through which businesses can manage their currency risk with minimum effort and at minimum cost. We also operate with complete transparency and our platform can be integrated into existing accounting software, such as Xero.

The main services which Bound provides to help businesses control their currency risk are forward trades and option trades. These allow a business that faces currency risk to fix the exchange rate that it receives for transactions that are planned for future dates. Forward trades simply prevent a company from facing any risk from an unfavourable change to the exchange rate. Option trades provide this reassurance as well, but also allow a company to benefit if exchange rates turn out to move in a favourable direction.

If your business imports or exports from the UK and you are familiar with the issue of dealing with currency risk, then head over to the Bound platform and find out how things work. Bound helps businesses of all sizes and, in particular, aims to help SMEs which have traditionally suffered from a lack of assistance with currency risk.

Stay up to date with insights

Enhance your finance skills by learning from our network of top industry experts