For some businesses which deal in foreign currencies, there is a constant need to manage the issue of exchanging currencies and completing transactions. For others, the requirement is less frequent but occurs for occasional large transactions.

Currency exchanges can be done immediately for a one-off transaction, without possible fluctuations in the rate being taken into account. Or they can be planned for the future, in which case careful management may be needed in order to avoid fluctuations in the exchange rate having a negative impact. Whatever the foreign exchange requirements a business has, it is important to plan carefully and use the right currency exchange services.

Increasingly, online platforms are being used by businesses that deal in foreign currencies because they offer simplicity, advanced features, and a high level of control.

Online platforms can readily be used for simple spot trade exchanges which take place at the current market rate. However, they are often most useful to businesses that need to carefully manage the risk they face from exchange rate fluctuations over time. This risk is known as currency risk. One study found that, for SMEs from the UK that import, 51% found currency risk to be the biggest problem they face. For exporters, it was slightly less at 34% but is still a significant problem.

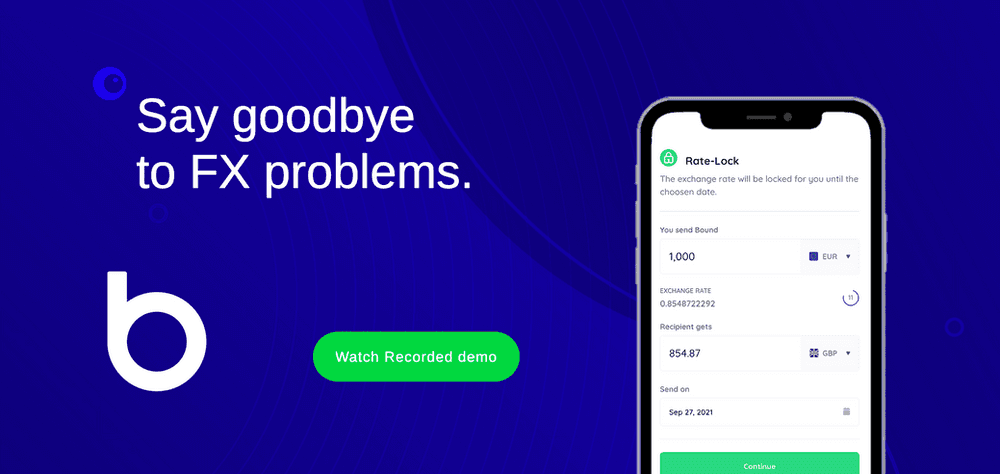

This article looks at how online platforms (as provided by Bound) can help businesses to manage currency exchange reliably, with simplicity, and at highly competitive rates.

Online Currency Exchange Platforms

Increasingly, businesses are taking to online platforms and more currency brokers are providing them to their customers.

Online platforms provide an automated service that handles currency exchange and international transactions. This service replaces what used to be lengthy manual processes involving discussion and management alongside, usually, a currency broker. As well as making the actual process of handling transactions easier, online platforms are more advanced in terms of the control and analytical features that they offer. On top of this, businesses can integrate them into their own accounting systems to provide a more streamlined overall system of currency exchange and international transaction management.

What Do Online Platforms Provide That Currency Brokers Can’t?

The key thing that online platforms do is let businesses that need to manage foreign exchange do so by themselves and at their own convenience.

Good online platforms provide:

24-hour payments

Live highly competitive rates

FX hedging tools (methods of eliminating currency risk)

Fast booking of trades

Full integration with accounting systems

Competitive and fixed rates

Transparency

Quick access to trade history

Understandability

Analytical software

Access to a wide range of currencies

Free use

With all of these features available on an easy-to-use interface, businesses that handle transactions in foreign currencies can control the system themselves and manage their operations far more efficiently and effectively.

Online Platforms Should Also Do Everything a Currency Broker Can

As well as providing the above features, online platforms should meet all the requirements that would be expected of a currency brokerage service. Good online platforms are 100% trustworthy, have a good reputation, and are backed up by a team of currency brokerage professionals who serve their customers well.

Good online platforms should:

Be FCA regulated. It is important to make sure that an online platform is regulated in the same way as a traditional currency broker. No business should risk putting their funds in the hands of a broker or online platform service which does not follow the regulations set out by the FCA.

Be contactable and support their customers. A good platform should have an easy-to-access team behind it that is readily available to support the businesses which use them.

Have a good reputation. A good platform should have a reputation for offering a good service.

Offer supporting information. Often currency exchange is confusing and this is particularly true when it comes to FX hedging (methods by which currency risk is managed). Background information on currency exchange and FX hedging can help businesses to better understand the process of exchanging currencies. Bound aims to simplify the world of FX hedging by providing easy-to-understand information on how it works.

What Alternatives Are There?

Generally speaking, for businesses that don’t wish to use online platforms, the alternative is traditional currency brokerage services. These are still a viable option and, as ever, offer better rates than banks do. For businesses that only have simple and low-value foreign exchange requirements, it may be better to stick to using a currency broker. For businesses that handle more complicated transactions or transactions that need a high degree of control, online platforms may well be worth investigating.

The Bound Platform

Bound provides an online platform that can help businesses to manage foreign exchange transactions. As well as accommodating spot currency exchanges (done at the current market rate) for immediate transactions, Bound is an expert in managing currency risk. For businesses that have a need to control the risk they face from exchange rate changes, the Bound platform can help them to do so with a great deal of ease.

Spot, Forward, and Option Trades

Bound provide spot, forward, and option trades which are three methods of exchanging currency that businesses commonly use when completing transactions in foreign currencies.

Spot Trades

Spot trades are used to exchange currencies immediately at the current market rate. These can be used to complete business transactions that happen immediately

On the Bound platform, spot trades are done using the live interbank rate, to make sure that customers always receive the best deal.

Forward Trades

Forward trades are used to hedge against risk when planning transactions in foreign currencies in the future.

When a Bound platform user books a forward trade, they set the exchange rate that they will receive for a future date. Bound will agree to exchange an amount of currency at a fixed rate on or before a future date. When the transaction goes ahead in the future, the forward trade is used to exchange currencies. If there has been an unfavourable change in the exchange rate in the meantime this will not matter to the business as it can rely on the forward trade to exchange currencies.

Option Trades

Option trades are also used to hedge against risk when planning transactions in foreign currencies in the future.

After a Bound platform user takes out a forward trade, they are committed to completing the forward trade. This is exactly the same for all forward trades provided by currency brokers. With an option trade, there is no such commitment.

A Bound platform user who books an option trade on the platform pays a small premium to do so. With an option trade, they have the right to exchange an amount of currency at a pre-agreed rate on or before a certain date. However, they are not committed to doing so.

This means that if, when the transaction is due, exchange rates have changed unfavourably they can use the option trade to exchange currencies. They will have avoided being negatively affected by the change in the exchange rate. If the exchange rate moves favourably, they can choose not to execute the option trade. Instead, they exchange currencies at the spot rate and benefit from the favourable change in the exchange rate.

Is it Worth Protecting Against Currency Risk?

Many businesses and many SMEs, in particular, do not do anything to manage currency exchanges when they are exposed to currency risk. Unfortunately, many businesses are losing out as a result. Exchange rates, particularly for the pound sterling (largely as a result of Brexit), have been highly variable in recent years. This trend also looks likely to continue. Variability, with big rises and falls in the value of the pound, leaves businesses that are unprotected at a higher risk of losing money.

One recent report found that around two-thirds of SMEs from the UK that trade in foreign currencies are negatively impacted by exchange rate changes. For these companies, the average loss, as a result, was around £70,000.

Currency exchange agreements that businesses can make, such as with a forward or an option trade, can remove currency risk entirely. On top of this, they are often more simple than people imagine. For example, the process of booking an option or a forward trade on the Bound platform is only slightly more complicated than waiting to exchange currencies at the spot rate.

Stay up to date with insights

Enhance your finance skills by learning from our network of top industry experts