If a currency has a floating exchange rate, also known as a fluctuating or flexible exchange rate, this refers to the way that its value in relation to other currencies is determined. Currencies with floating exchange rates are known as floating currencies.

If a currency has a floating exchange rate this means that it is freely available to be bought and sold on the foreign exchange markets and that its value is set by the level of supply and demand for it. If there is an increase in demand for a currency, its value will increase in relation to other currencies, and vice versa.

With a floating exchange rate, the exchange rate available for a currency is constantly shifting with the forex markets.

Floating exchange rates compare to fixed exchange rates, in which governments either partly or completely set the exchange rates which are available for their country’s currency.

Exchange rates have a big impact on the way that a country is able to trade. As the value of its currency increases, its ability to import is increased. As the value of its currency decreases, its ability to export increases. Exchange rates are one of the key factors for businesses that conduct trade in foreign currencies.

What Existed Before Floating Exchange Rates?

Before the introduction of floating exchange rates, most of the major currencies of the world set their value according to the gold exchange standard. This followed an agreement made between 44 of the allied countries of World War II at the Bretton Woods Conference in 1944.

At the Bretton Woods conference, these 44 countries established the International Monetary Fund (IMF) and the World Bank, as well as bringing the gold exchange standard system into being.

Under this system, the value of an ounce of gold was set at $35, giving a fixed value to US dollars. Other countries would then set the value of their currency against the US dollar as an exchange rate against US dollars. Finally, central banks were permitted to exchange dollar holdings into gold at the rate of $35/ounce to solidify the system of fixing currency values in terms of gold.

All the currencies which participated had a fixed value in terms of gold, the exchange rates between them were fixed as well and there was a system of fixed exchange rates.

What Was Wrong With This System?

This system collapsed in the 1960s and early 1970s. During the 1960s, the dollar was seen as overvalued. Among other events, France (one of the participating countries) began exchanging its dollar reserves for gold. The effect of this alongside an increase in US spending on Lyndon Johnson’s Great Society programs and a rise in spending on the Vietnam War caused the dollar to become increasingly overvalued.

The gold exchange standard system had struggled throughout the 1960s and it came to an end in 1971 when President Nixon announced the end of convertibility of US dollars into gold. As this guarantee had underpinned the system, it collapsed.

Shortly afterward, the system of floating exchange rates came into effect.

Floating Exchange Rates

As we already mentioned, under a floating exchange rate system there is no system of control in place which governs the exchange rates which are available for a currency.

Broadly speaking, the value of a currency is set in the same way that other commodities are. Currencies are available to be bought and sold on the foreign exchange markets and the level of demand sets the price. If demand for the British pound increases for example, while demand for the euro decreases the value of the pound will increase against the euro. More pounds will buy more euros as a result.

At a basic level, the exchange rate between two freely floating currencies is first determined by the interest rate differential between the two currencies. That is the difference between the domestic interest rates for both currencies. This will have an influence on the value of the two currencies in relation to each other over time.

Otherwise, the value of the two currencies is determined by demand according to the free-floating system.

Longer-term, the economic strength of a country will affect demand and, in the short term, smaller fluctuations reflect things like speculation moves, political events, natural disasters which affect economic output and, sometimes even, events that aren’t entirely understood.

Government Influence

While it is true that free-floating currencies are predominantly determined by supply and demand, central banks still participate in the markets in order to influence exchange rates.

If the value of a currency becomes too high or too low, this will affect the ability of a country to trade in the way that it would like to. Alternatively, it may be more difficult for it to repay debts. As a result, governments are constantly implementing measures to influence the value of their currencies.

A national bank, such as the Bank of England for example, may influence the value of its national currency by buying or selling it in large quantities. When the value of the British pound drops, the Bank of England may choose to use its Exchange Equalisation Account to buy pounds. Similarly, if the value of the pound rises the Bank of England can sell pounds if it is deemed necessary. Also, influence can be exerted by raising or lowering domestic interest rates. This will influence the number of investors who choose to invest in the country.

Often a country’s government will set limits in which it allows its currency to float freely without intervention and only intervenes if the limits are breached.

Some people regard free-floating currencies as ‘managed float’ currencies instead of truly free-floating currencies because the level of influence which ends up being exerted can be quite substantial.

How Successful Have Floating Exchange Rates Been?

Many regard floating exchange rates as preferable to fixed exchange rates.

Largely, this is because, with a fixed exchange rate, monetary policy has to be devoted to maintaining exchange rates at the set level. Without this commitment, monetary policy can be used to stabilise domestic employment levels or to stabilise inflation, for example. Without the commitment to a fixed exchange rate, a country has greater control over its overall monetary system.

The major downside to free-floating exchange rates is that they become unpredictable and highly variable. While this may allow speculators to profit in some instances, for business, unpredictability can be a problem. The more variable and unpredictable a currency’s exchange rate, the more difficult it is to do business with it.

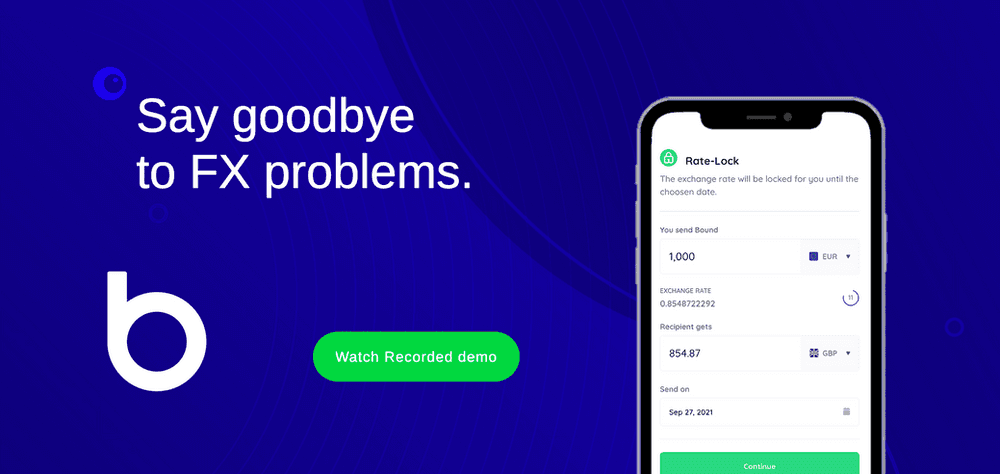

The issue of currency instability in business is something that Bound is very familiar with.

What Does Bound Do?

Bound, the writers of this article specialise in providing businesses that deal in foreign currencies with ways of controlling the risks they face from fluctuating exchange rates. When this risk is left uncontrolled it can cost businesses a large amount of money.

However, there are ways that businesses can fix the exchange rates that they receive for future dates. This allows them to operate with complete clarity about what their income and expenditure in foreign currencies will be.

Which Countries Still Have Fixed Exchange Rates?

As a result of an aversion to the unpredictability of free-floating exchange rates, there are still countries that operate with a fixed exchange rate. Often, these are developing countries which without having the ability to fix exchange rates would have currencies with a very high degree of variability and unpredictability.

In order to fix their exchange rates, these countries usually have some form of government control that ties the exchange rate to either another country’s currency or to the value of gold. While there will still be some variation as either the value of gold or the other currency varies, the exchange rate will be much more stable than if the currency was free-floating.

Why Do They Have Fixed Rates?

Having fixed rates allows these countries to have a greater degree of certainty when it comes to importing and exporting than they otherwise would. Also, it allows them to keep inflation at low levels and low levels of inflation are helpful in stimulating trade.

The stability they offer is generally thought to be beneficial in terms of long-term economic growth.

While this is true, these fixed-rate systems are not without their problems. They limit a government’s ability to adjust interest rates which can hinder economic growth. It also requires a large pool of reserves to be kept in place for when the currency is struggling. On top of this, if the exchange rate is fixed at a level that becomes unrealistic then an unofficial exchange rate can develop. When this happens, currency can be diverted away from the central bank which can lead to forex shortages or devaluations.

Stay up to date with insights

Enhance your finance skills by learning from our network of top industry experts