Companies that either import or export as part of their business may end up trading in foreign currencies. Where companies end up conducting business in foreign currencies, they usually expose themselves to some level of currency risk. This is the risk that an adverse move in exchange rates will cause them to lose money.

There are various ways in which businesses can protect themselves from currency risk and they are referred to as forms of FX hedging. When a business hedges against the risk of fluctuations in the exchange rate, it gives itself an alternative to exchanging currencies at the spot rate. The spot rate is the current market exchange rate at any point in time.

A common form of currency risk is known as transaction risk. It comes from a time gap between the day the company makes a sale or agrees to buy in a foreign currency and when it actually takes place. In the time that passes, exchange rates can change for the worse and this will cause money to be lost.

What businesses look for is a way to fix the exchange rate for the future when the sale or purchase is agreed to. This way they don’t have to face the risk of suffering because of an adverse move in the exchange rates. The exchange rate is fixed for the future and this makes it easier to conduct business.

One way that this is done is through money market hedges and this article will explain what they are and how they work.

How a Money Market Hedge Works

With a money market hedge, a business uses the money market to effectively lock in the current exchange rate for a future date. The hedge is set up in advance of an expected transaction taking place in a foreign currency.

What the business will do is either lend money to or borrow money from the money market in the foreign currency that the transaction is expected to take place in. By taking this course of action ahead of time the exchange rate is effectively locked in. When the actual transaction goes ahead in the future, the hedge then comes into effect.

If the company is making a purchase in a foreign currency, they will have lent money to the money market. The money lent at the original exchange rate is used to make the payment.

If the company is receiving money in a foreign currency, they will have borrowed money from the money market. The money received from the transaction is used to satisfy the loan that was taken from the money market at the original exchange rate.

What are the Money Markets?

The money market is an organised market in which short-term financial instruments are traded. Short-term financial instruments are things like treasury bills, repurchase agreements, and short-lived mortgage and asset-backed securities. Governments, banks, and other large financial institutions can go to the money markets to sell short-term securities in order to fund cash flow needs.

While this is the main purpose of the money market, it also allows smaller investors to lend and borrow money in a low-risk setting. Dealers and money market mutual funds provide a means of access to the money markets for large corporate businesses or smaller businesses. Individual investors can invest in the money markets through money market mutual funds and they are a widely accessible way to lend and borrow money.

How to Hedge a Payment with a Money Market Hedge

If a company is anticipating that it will make a payment in a foreign currency at a future date it can hedge against currency risk by carrying out a money market hedge. As we said earlier, currency risk is the risk that money will be lost due to a change in the exchange rate which occurs between the time that the company agrees to make the purchase and that payment is actually made.

What the company does is deposit a calculated sum of foreign currency in the money market ahead of time. When the purchase is agreed to, the company exchanges currency at the exchange rate which is available at that time. The foreign currency is then deposited in the money market, and it sits until it is time to make the payment.

The amount that is deposited at that time is calculated to take interest into account, but ultimately it will be the cost of the payment at today’s exchange rate. When the time comes to make the payment, the money which has been deposited in the money markets is used to make the payment.

If the company had simply waited to make payment instead, they would have been vulnerable to the effects of the exchange rate.

How to Hedge a Receipt with a Money Market Hedge

Hedging a receipt of money in a foreign currency is really just the same thing backward. What the company does is immediately borrow money from the money market after it has made a sale in a foreign currency.

When another business or customer agrees to purchase from the company in a foreign currency, they will again set up their money market hedge ahead of time. The money markets are used to borrow money. Again, interest rates are taken into account but ultimately what is borrowed is the value of the payment at today’s exchange rate.

When payment is received in the foreign currency it is used to repay the loan that was taken from the money market and the company keeps the funds that they originally borrowed. Again, any effects from the exchange rate were negated at the start of the process.

Would a Forward Trade be Better?

While money market hedges are an effective way of hedging against currency risk, there are other ways to do it. One of the most common ways is with a forward trade. To many, it may seem that money market hedges are unnecessary when simpler alternatives like forward trades are available.

What is a Forward Trade?

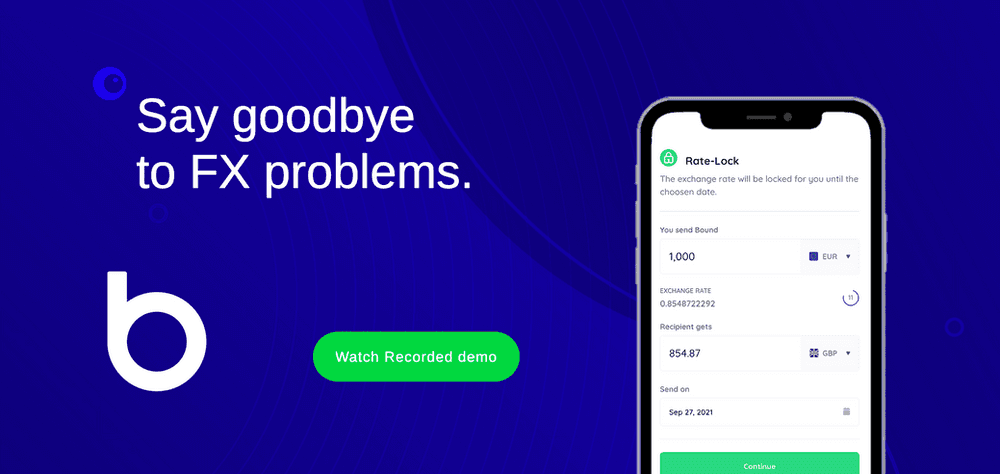

With a forward trade, a company that is set to complete a transaction in a foreign currency at a future date can simply fix the exchange rate that it receives on that date. They will approach a third party, traditionally a currency broker, although other avenues are open nowadays. This third party will facilitate the transaction and agree to fix the exchange rate in advance.

For example, if a company has made a sale in a foreign currency for which payment will be received at a later date, they can approach a forward trade provider to take out a forward trade. The forward trade provider will agree to exchange an amount of currency on or before a future date and, crucially, this will be at a fixed exchange rate. Again, any unfavourable movements in the exchange rate which take place between the date of the sale and the date that the money is received are negated by the agreement made in the forward trade.

Forward trades are equally useful for payments in foreign currencies, with a company able to lock in the exchange rate that it receives to convert its domestic currency into a foreign currency ahead of time.

Would a Forward Trade be Better than a Money Market hedge?

The process involved in setting up a money market hedge is typically more complicated than it is with a forward trade and it may seem that forward trades are an obviously preferable alternative. For the most part, forward trades are simpler and more likely to be the chosen way to hedge against currency risk when trading in foreign currencies.

That said, money market hedges can be useful for companies that are trading in exotic currencies. On some occasions, it is more difficult to set up a forward trade than it is to set up a money market hedge for certain currencies.

Also, traditionally money market hedges have been more suitable to smaller businesses as forward trades have been inaccessible to them. Previously, only larger businesses tended to use forward trades. However, platforms like the Bound platform and other currency brokers for SMEs now make it possible for smaller businesses to benefit from having access to forward trades.

What are Option Trades?

As well as forward trades, another similar commonly used method of hedging against currency risk is through option trades. These, in a way, are similar to forward trades but there is a key difference.

With a forward trade, once it has been agreed to, there is a commitment by both parties to complete the exchange of currencies. They are contractually obliged to see the exchange of currencies through. With an option trade, they are not.

What this means is that a company that has hedged against risk with an option trade has exchange rate security but is not committed to a particular exchange rate.

Option trades are, as with forward trades, taken out in advance of an anticipated transaction. When the time comes to complete the transaction, the company which has taken it out can pay attention to the exchange rate. If the exchange rate has moved adversely, the exchange rate in the option trade can be used as it will prevent them from losing money. If the exchange rate has moved favourably, they can disregard the option trade. They exchange at the spot rate (current market rate) instead and benefit from doing so.

Stay up to date with insights

Enhance your finance skills by learning from our network of top industry experts