The spot exchange rate is the rate at any point in time at which one currency can be immediately exchanged for another.

If, for example, the spot exchange rate for pound sterling to euros is 1.15 GBP/EUR, then at that moment in time £1.15 is worth €1.

The actual rate offered at the spot exchange rate is governed by the foreign exchange market. This is the global market in which currencies are bought and sold and encompasses everything from banks which trade billions worth of US dollars in various currencies to individuals who exchange small amounts of cash. This is the largest market in the world and exchange rates are constantly shifting in the market with many dramatic and sudden shifts in value taking place.

Spot markets compare to markets like the futures and forwards market, where prices are set on one day for exchanges that take place in the future.

What is a Spot Trade?

The spot exchange rate is used when executing foreign exchange spot transactions, or spot trades as they’re otherwise known.

These are the most common form of foreign exchange transactions and are the kind that most people are familiar with. Spot exchanges are immediate exchanges of currency done at the current market rate. Normally, after a spot exchange is agreed upon, the exchange of currencies must be completed within two working days.

Trillions of US dollars worth of spot trades happen on a daily basis with various parties executing spot trades, from investors to speculators to businesses handling transactions in foreign currencies.

How to Execute a Spot Trade

There are various ways of executing a currency spot trade.

A simple version of a spot trade and the one that everyone is familiar with is a cash exchange at a bureau de change. With this kind of spot exchange, an amount of cash is immediately exchanged at the spot rate, minus the commission that the bureau de change charges.

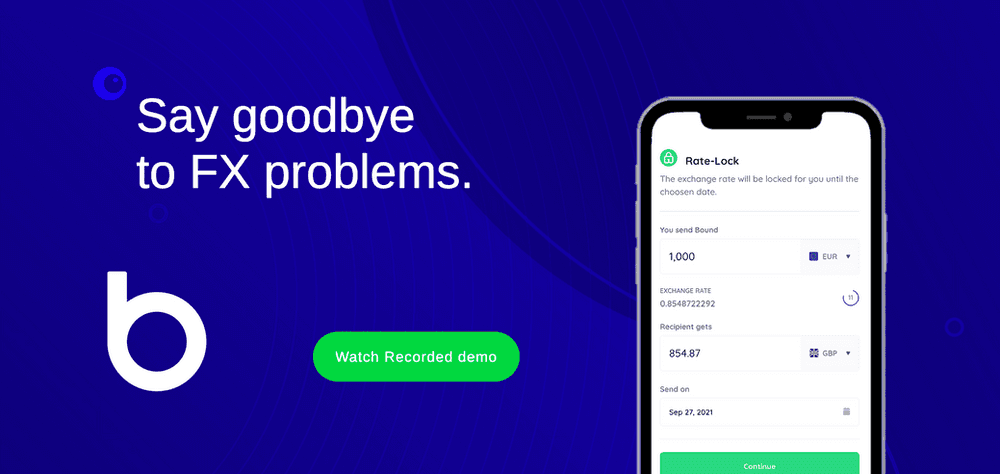

As well as this basic version, there are many more advanced ways that spot trades are executed. Many business transactions made between companies from different countries are handled through intermediaries, such as currency brokers. Bound is also a company that provides this service. In this instance, the third party handles the entire transaction including the exchange of currencies.

On top of this, there are more ways of executing spot trades including through automated systems that allow users to place orders for a currency that are fulfilled when they become available. Often orders are triggered as soon as the exchange rate reaches a certain level.

How is the Spot Exchange Rate Decided?

For the most part, the spot exchange rate is decided by the foreign exchange market. For free-floating currencies, which include all of the major industrialised countries on earth, this is particularly true. Free-floating currencies are traded freely on the foreign exchange market and as demand increases, the price goes up, and as it decreases it goes down. As a result, the value of currencies goes up and down with the market.

If, for example, the value of the pound sterling increases from 1.15 to 1.20 to the euro (going back to our earlier example), this could mean that there has been an increase in demand for the pound. More buyers are buying the pound and its price has gone up as a result. Alternatively, demand for the euro may have gone down causing the euro’s value to fall in comparison to the pound.

The value of currencies changes just like commodities, such as coal or oil. As their individual value changes, so does their value in comparison to each other and this is what sets the exchange rate.

Fixed Currencies

While this is true, many currencies actually have fixed exchange rates and do not float freely on the foreign exchange market.

What many governments do to control the value of their currency and to make it more stable is fix the value of it against another currency like the US dollar. Rather than fluctuating in value according to foreign exchange market demand, the value of these currencies shifts as the currency to which they are fixed does.

The value then does not fluctuate against the currency to which it is fixed, however, it does fluctuate against the value of other currencies in line with the value of the currency it is fixed to. The effect is not caused by supply and demand for it on the foreign exchange market.

Government Intervention

Another interesting point about free-floating currencies is that governments intervene in the money markets to manipulate their value. There are various reasons for doing this, but it is important to understand that the value of a nation’s currency is very influential in its trading position and that fluctuations can sometimes be problematic. Having the ability to influence exchange rates can be very beneficial.

One example of a way in which governments influence exchange rates is by buying and selling their own currency. In order to do this many governments and central banks keep vast reserves of currency. If they would like to raise the value of their currency, they can buy up large amounts of it and artificially increase the price. If on the other hand, they would like to lower the value of their currency, they can sell large amounts of it and artificially decrease the price.

As an example, the UK’s central bank, the Bank of England, uses its Exchange Equalisation Account to exert influence on the value of the pound sterling.

How Much Do Spot Rates Vary?

Spot exchange rates for many currencies consistently vary and there are relatively regular significant collapses in the values of currencies.

As an example, the exchange rates for pound sterling to euros, euros to US dollars, and the pound sterling to US dollars have often changed over 3% in just a month.

What Alternatives to Spot Trades are There?

The fact that exchange rates fluctuate can be troublesome. While speculators may make money as a result of it, they also lose it. On top of this, making business decisions involving foreign currencies can be difficult when it is impossible to know what the spot exchange rate will be in the future.

Currency Risk

One of the largest users of spot trades is small and medium-sized enterprises that conduct business in foreign currencies. Unfortunately, many of these businesses are negatively affected by changes to the exchange rate. Often, the reason that these businesses use spot trades is that they are unaware that the alternatives which exist could be useful to them.

In many cases, the alternatives to exchanging currency at the spot rate which has been devised are specifically intended for use by businesses.

Forward and Option Trades

Forward and option trades are two such examples.

A forward trade can be thought of as moving a spot trade forward. When a business takes out a forward trade, they will approach a third party that oversees a transaction of theirs, including the exchange of currencies. This third party will fix the exchange rate in advance for a future date. The exchange rate which is used is the forward rate, which is just the current spot rate adjusted to take into account the interest rate of the two currencies which are to be exchanged. It is essential to take into account the effect that the interest rate has on an exchange rate over time.

The business can then plan a transaction for the future, safe in the knowledge that they will be able to receive a certain exchange rate for it when the time comes.

As useful as they are, the slight drawback to forward trades is that once a business has taken one out, they are committed to completing the exchange of currencies.

This is where option trades can be useful. With an option trade, a business will be able to approach the same third party to oversee their transaction, including the exchange of currencies. This third party will agree on a minimum exchange rate for a future transaction, giving security about the exchange rate available in the future.

The difference is that the business is not committed to completing the exchange of currencies. This brings various advantages. One interesting is that if, when the time comes to complete a transaction, it transpires that exchange rates have fluctuated to what is actually a favourable rate, the business can opt-out of the option trade. They then take a spot trade instead and benefit from the favourable change to the exchange rate.

With an option trade, there is the same security as there is in a forward trade, but there is also flexibility. This flexibility could lead to higher-than-expected profits being earned or costs being cheaper than expected.

What Else is There?

It’s not just forward trades and option trades that are available. For a long time, particularly since the 1970s when the gold exchange standard collapsed and free-floating currencies were introduced, businesses have been working to control currency risk.

As a result, there are various ways that businesses can control the risk they face from exchange rates. Currency futures, money market hedges, FX swaps, and matches are all examples of methods by which businesses look to control their currency risk.

Stay up to date with insights

Enhance your finance skills by learning from our network of top industry experts