Currency risk, or exchange rate risk, refers to the exposure faced by investors or companies that operate across different countries, in regard to unpredictable gains or losses due to changes in the value of one currency in relation to another currency ~CFI definition.

If you are a business that trades with suppliers or customers in other countries, or has employees based abroad, you’re likely dealing with foreign currencies and have currency risk hiding in your finances. Almost every high-growth company has to deal with currency risk as an unwanted by-product of doing business globally, but few understand its true impact on finances.

Currency risk explained

Currency risk can be as insidious as it is complicated. Understanding exactly where and how currency fluctuations affect your business’s cash flows can involve many different factors - from macroeconomic trends across countries to competitive behaviour within market segments.

FX risk comes in many shapes and sizes, here are examples of the main types can distort your company’s cash flows:

Transaction risk

Take the example scenario: you’re a Dutch tech firm, but half your sales are in the US. You generate revenue in USD but most of your staff are in Europe. These monthly salary payments require frequent bulk conversions from USD to EUR. If the EUR gets stronger compared to USD, then suddenly you're margins have decreased.

Translation risk

Okay now let’s look at one of your subsidiaries in the US. You’re pleased because it's generated strong returns in USD this year. However, when you translate the earnings into EUR for your quarterly financial statements, the returns don't look as good. What happened? EUR strengthened compared to USD and the financial statement values are affected, that’s translational risk.

Economic risk

Continuing with the same scenario, the majority of your tech products are sold in Europe in EUR revenue. While it may seem that this revenue is risk-free, that is not the case. You are still in contention with imports from Asia and the US, which will get cheaper and more competitive if the EUR strengthens. Economic risks tend to be very difficult to account for, and even more difficult to predict.

If you want a deeper look into the different types of risks and what to do about each one, take a look at this article we’ve written.

How much currency risk do I have?

Let’s look at some numbers.

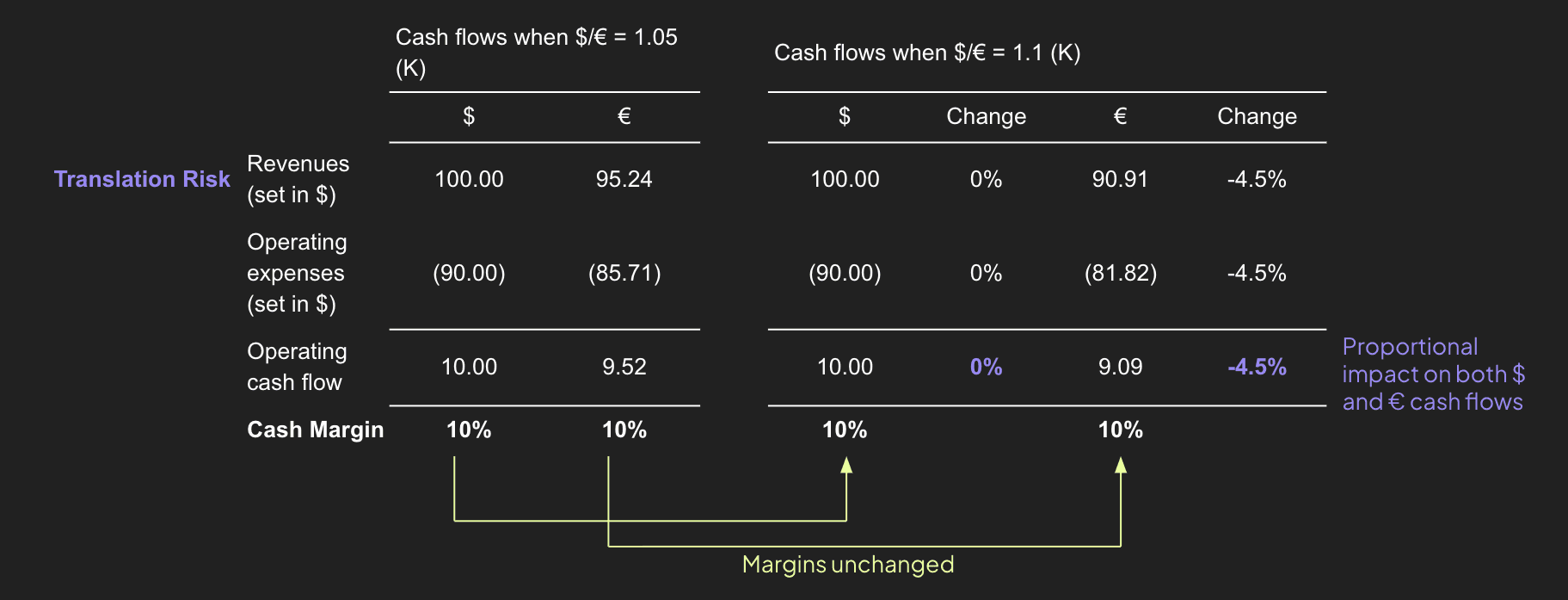

Using our earlier example, assume the US subsidiary generates $100K with a cash margin of 10% of sales, and reports in EUR.

Taking only translational risk into account, a ~5% change in exchange rate would lead to a proportional ~5% change in the company’s cash flows from its foreign operations.

Now let’s take it a step further.

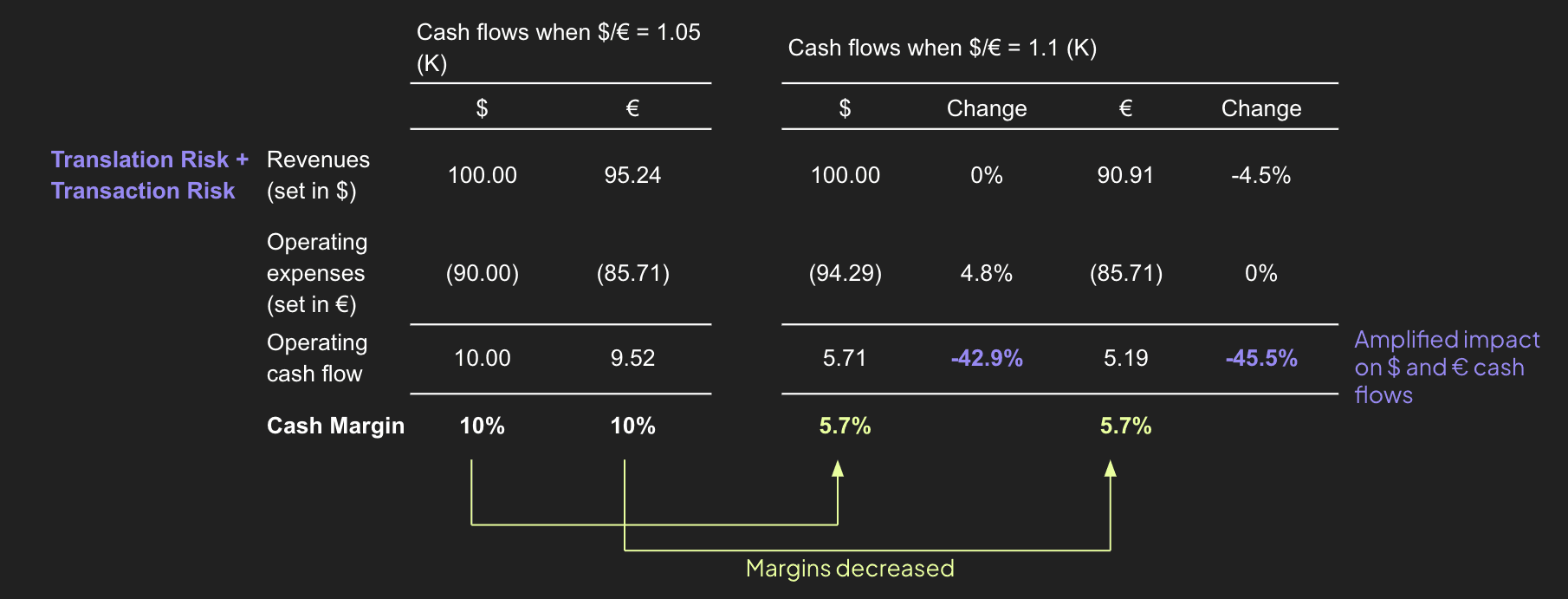

If this subsidiary is structured such that it generates sales in USD but the costs are incurred in EUR, then the situation looks much worse. In this simple hypothetical case, a mere 5% drop in USD compared to EUR would deflate the cash margin to 5.7%. The operating cash flow would also take significant hits - a 42.9% decline in dollar cash flow and 45.5% in euros.

In this case the company’s cash inflows and outflows are structured such that they react differently to fluctuations, which has exposed them to far greater currency risk. Differences in timing of paying costs and collecting revenue can exacerbate the problem.

In 2022, EUR/USD exchange rates varied almost 20%. A USD drop of that size would have swung the cash flows of our Dutch tech company way into the negatives and annihilated our margins.

Most real-world examples are not so clear-cut and have more moving parts, but this example makes the principle clear.

To completely understand your currency risk, you’d need to:

Outline the timing and amounts of all company outflows in local and foreign currencies

Outline the timing and amounts of all company inflows in local and foreign currencies

Line them up to look for any natural hedges. A natural hedge is when a company has a cost in a foreign currency, but also has some offsetting revenue in that currency, so those amounts are not at-risk to currency fluctuations.

Identify the timing and quantify the amount of the risk as it changes in time

Is currency risk worth solving?

So is solving currency risk worth it for you? Perhaps you’ve been doing business without managing your currency risk for many years and you just view this as a cost of doing business.

You may also think that these are negative examples, surely I will win as often as I lose? Should it not all balance out?

A reasonable argument.

If you have a small amount of money at risk and you can weather potential losses, sometimes it makes sense to do nothing.

However, most CFOs prioritise predictability and protection instead of letting their cash flows ebb and flow at the market’s whim. The examples demonstrate the risk behind currency fluctuations, which can cause severe swings in margins, budgets, and create all sorts of uncertainty in financial forecasts.

Whether or not solving currency risk is worth the effort depends on your business. Some questions to consider:

Would a 5 percent adverse currency swing significantly impact my business, or could I weather that easily? These types of movements are quite common.

Could I also absorb a more dramatic change, like 20 percent? These happen less frequently so can I deal with these periodically?

How easily and how accurately can I project the timing and amounts of my foreign transactions? And how much time would it take me?

How well do I understand the basic financial products to manage these risks?

Typical solutions

Hedging is the method most companies deal with currency risk.

Almost all large companies have professionals that manage currency risk. International conglomerates often have tens of millions at risk and value predictability in costs and revenue.

They can afford to hire or work with risk professionals to protect their businesses. For large-scale problems, they may work with a bank or an FX broker on a large-scale solution with financial projections, risk analysis, and use complex hedging strategies.

However, most smaller businesses don’t have the time or resources to commit to even understanding where currency risk is hiding in their operations--let alone putting together packages of financial products that would help mitigate these challenges.

Bound aims to make this entire process easier for small to mid-sized businesses by providing accessible and automated solutions for mitigating currency risk.

Feel free to contact us if you think this sounds like something for your business.

No opinion given in the material constitutes a recommendation by Bound Rates Limited that any particular transaction or investment strategy is suitable for any specific company or person. Results may and will vary. The information in this publication does not constitute legal, tax or other professional advice from Bound Rates Limited or its affiliates.

Stay up to date with insights

Enhance your finance skills by learning from our network of top industry experts