control

stabilise

protect

control

stabilise

protect

control

stabilise

protect

your foreign currency.

your foreign currency.

Designed for busy finance teams.

No expertise required. No phone calls needed.

Designed for busy finance teams.

No expertise required. No phone calls needed.

Swedish office

SEK 1,385,703

Design studio

PLN 197,700

AWS bill

USD 62,508

Stripe revenue

EUR 340,000

Venture round

USD 20,000,000

Monthly foreign cash flows

~GBP 526,272

Where are your currency headaches?

Foreign revenues

Foreign expenses

Making foreign loans

Raising venture capital

Raising venture debt

Foreign investment/divestment

Balance sheet hedging

Fund management fees

Foreign revenues

Foreign expenses

Making foreign loans

Raising venture capital

Raising venture debt

Foreign investment/divestment

Balance sheet hedging

Fund management fees

Foreign revenues

Foreign expenses

Making foreign loans

Raising venture capital

Raising venture debt

Foreign investment/divestment

Balance sheet hedging

Fund management fees

Foreign revenues

Foreign expenses

Making foreign loans

Raising venture capital

Raising venture debt

Foreign investment/divestment

Balance sheet hedging

Fund management fees

Foreign revenues

Foreign expenses

Making foreign loans

Raising venture capital

Raising venture debt

Foreign investment/divestment

Balance sheet hedging

Fund management fees

Foreign revenues

Foreign expenses

Making foreign loans

Raising venture capital

Raising venture debt

Foreign investment/divestment

Balance sheet hedging

Fund management fees

Foreign revenues

Foreign expenses

Making foreign loans

Raising venture capital

Raising venture debt

Foreign investment/divestment

Balance sheet hedging

Fund management fees

Foreign revenues

Foreign expenses

Making foreign loans

Raising venture capital

Raising venture debt

Foreign investment/divestment

Balance sheet hedging

Fund management fees

Foreign revenues

Foreign expenses

Making foreign loans

Raising venture capital

Raising venture debt

Foreign investment/divestment

Balance sheet hedging

Fund management fees

Foreign revenues

Foreign expenses

Making foreign loans

Raising venture capital

Raising venture debt

Foreign investment/divestment

Balance sheet hedging

Fund management fees

Foreign revenues

Foreign expenses

Making foreign loans

Raising venture capital

Raising venture debt

Foreign investment/divestment

Balance sheet hedging

Fund management fees

Foreign revenues

Foreign expenses

Making foreign loans

Raising venture capital

Raising venture debt

Foreign investment/divestment

Balance sheet hedging

Fund management fees

Want to learn how Bound helps high-growth companies like yours?

Why do finance teams at high-growth companies choose Bound?

Protect your profits

Currency changes can impact profits. Hedging locks in exchange rates to protect you from market fluctuations

Protect your profits

Currency changes can impact profits. Hedging locks in exchange rates to protect you from market fluctuations

Protect your profits

Currency changes can impact profits. Hedging locks in exchange rates to protect you from market fluctuations

Stabilise your cash flows

Currency swings can disrupt cash flow. Hedging makes it more predictable

Stabilise your cash flows

Currency swings can disrupt cash flow. Hedging makes it more predictable

Stabilise your cash flows

Currency swings can disrupt cash flow. Hedging makes it more predictable

Automate currency transfers

Save time and let your team focus on what matters by automating currency transfer for international operations.

Automate currency transfers

Save time and let your team focus on what matters by automating currency transfer for international operations.

Automate currency transfers

Save time and let your team focus on what matters by automating currency transfer for international operations.

Benefit from market upside

Smart hedging allows you to take advantage of favourable market changes while protecting against the bad ones

Benefit from market upside

Smart hedging allows you to take advantage of favourable market changes while protecting against the bad ones

Benefit from market upside

Smart hedging allows you to take advantage of favourable market changes while protecting against the bad ones

What makes us different from Wise, banks or brokers?

It’s as simple and straightforward as spot trading – just with the added benefit of planning ahead to protect your business from currency changes.

An easy-to-use FX hedging platform that empowers you to achieve predictable cash flow, offering protection while allowing you to benefit from favourable market movements.

How much time do you want to spend on FX each month? If the answer is "as little as possible" Bound is for you.

No expertise needed: Our platform is simple to use.

Intuitive platform: You can manage everything in a few clicks – no brokers, no hassle.

Don't fear mistakes: Modify or cancel hedges instantly.

Transparent pricing: No hidden fees.

PRODUCT TOUR

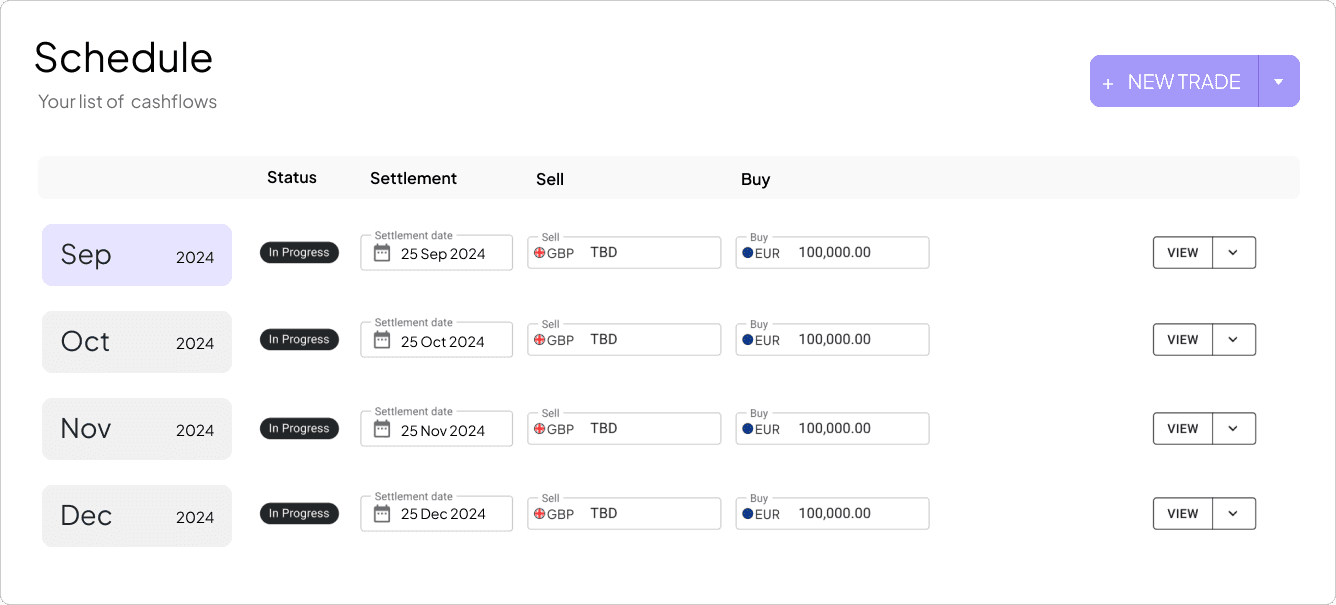

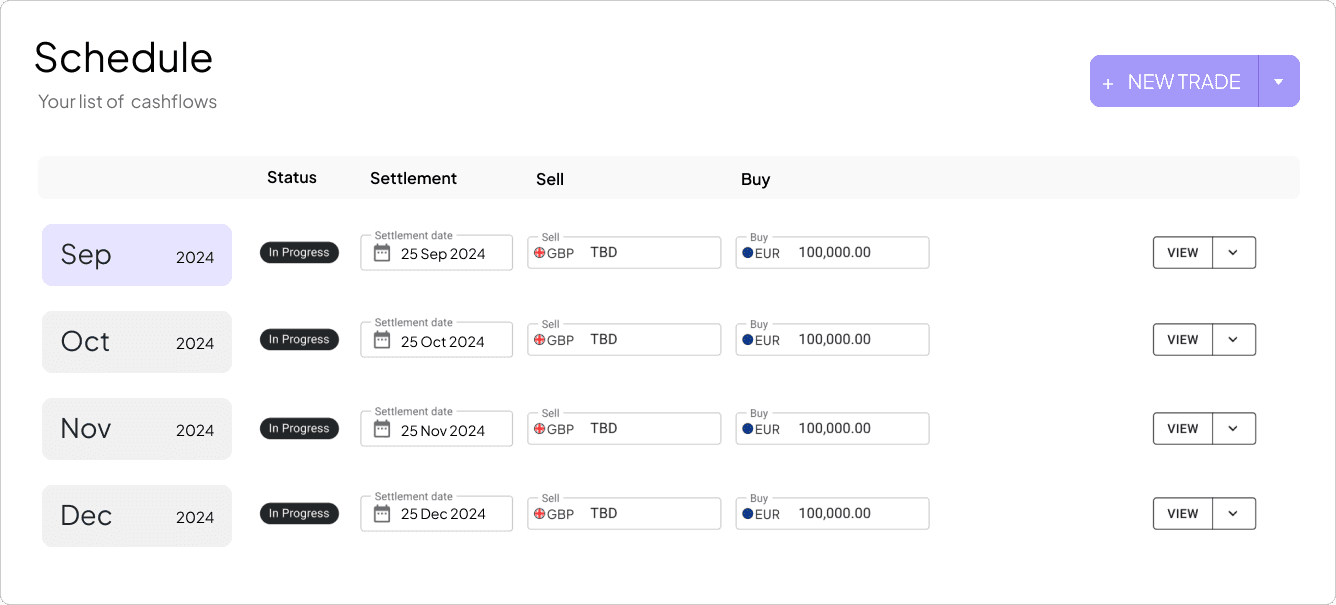

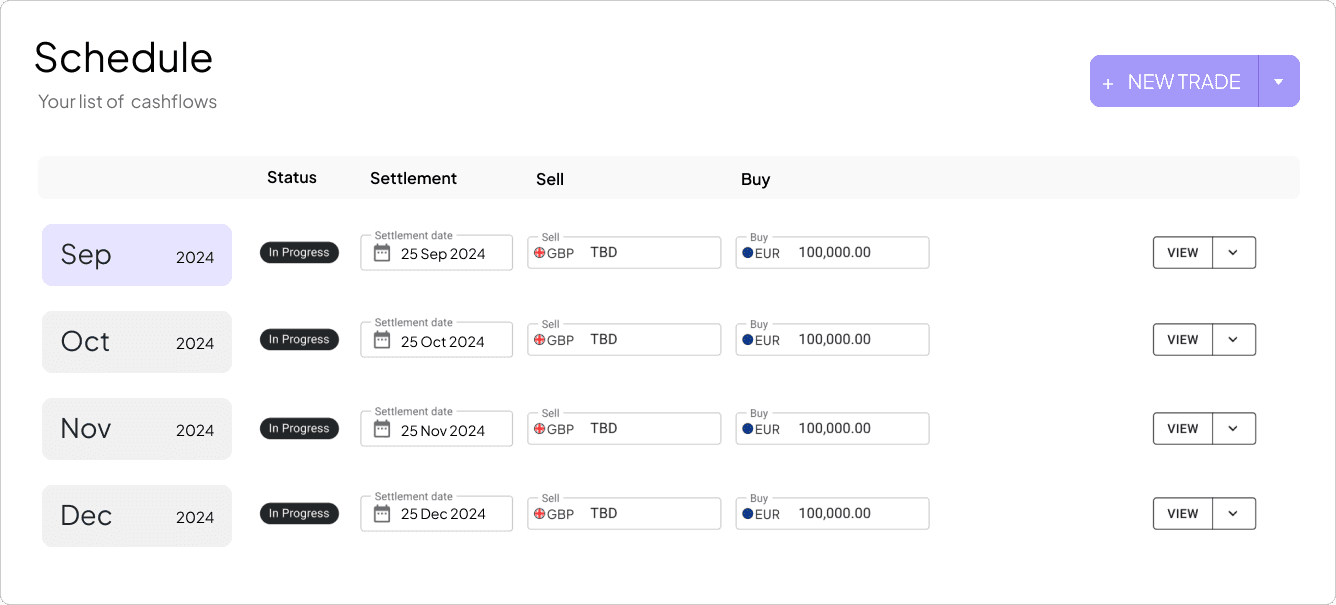

We're not kidding, it's that easy

See how easy it is to setup and amend trades with Bound

Product tour

PRODUCT TOUR

We're not kidding, it's that easy

See how easy it is to setup and amend trades with Bound

Product tour

PRODUCT TOUR

We're not kidding, it's that easy

See how easy it is to setup and amend trades with Bound

Product tour

You're in the right place

Don't just take our word for it – hear real success stories.

Khushil Patel

Senior management accountant

"It was clear that Bound stood out due to its simplicity and effectiveness. The additional charges from banks and the complexity were a hassle we wanted to avoid. Bound delivered exactly what we needed."

Khushil Patel

Senior management accountant

"It was clear that Bound stood out due to its simplicity and effectiveness. The additional charges from banks and the complexity were a hassle we wanted to avoid. Bound delivered exactly what we needed."

Click me

Khushil Patel

Senior management accountant

"It was clear that Bound stood out due to its simplicity and effectiveness. The additional charges from banks and the complexity were a hassle we wanted to avoid. Bound delivered exactly what we needed."

Nic Lowden

Head of Finance

"For a firm like ours, managing investments in multiple currencies, Bound is a game-changer. It’s simple and gives us the predictability and control to keep growing."

Nic Lowden

Head of Finance

"For a firm like ours, managing investments in multiple currencies, Bound is a game-changer. It’s simple and gives us the predictability and control to keep growing."

Click me

Nic Lowden

Head of Finance

"For a firm like ours, managing investments in multiple currencies, Bound is a game-changer. It’s simple and gives us the predictability and control to keep growing."

Derek Livingstone

Head of Treasury

"It definitely saved time. And setting the hedging strategy up online took five minutes rather than hanging on the phone."

Read full case study

Still got questions?

Is my money safe?

We are regulated by the FCA and all funds in relation to regulated contracts are protected in line with the FCA's rules when not in settlement. Please see more at https://bound.co/legal/safeguarding

Why are you cheaper than banks or brokers?

Bound is plugged into a liquidity aggregator. When you enter a quote, several banks and financial institutions compete for your transaction. Bound displays the best quote on your screen with a fixed, transparent spread added. The traditional FX model typically hides costs, particularly when amending transactions. Bound displays transparent spreads not only on booking, but also on amendments and cancellations.

How long does your onboarding take?

1 week or less, depending on how fast you want to move

How does settlement work?

Fund your Bound wallet via a bank transfer (funding cutoff is at 11am GMT). Most currency pairs settle same-day - no cash tied up in advance. Miss a cutoff? The settlement date rolls over to the next day at no cost. All payouts are automated and amounts over $100k are sent via SWIFT with MT103 receipts.

Do you have a floor to start trading?

The minimum is $1M or equivalent per annum. Bound customers typically transact between 7 to 8 figures.

FX is new to me, would a broker be easier?

Our platform is easy to use, and our specialists are here to guide you through setting up your hedges with as much or as little help as you need.

My bank offers me a cheap rate, why would I choose Bound?

Our platform lets you manage everything quickly, without calls or emails to banks or brokers, putting you in control. Enjoy transparent pricing, flexible strategy adjustments, and clear financial insights.

How does your pricing work?

No sign-up fees or hidden costs. Visit our pricing page https://bound.co/tools/spot-forward-pricing for more details.

Is my money safe?

We are regulated by the FCA and all funds in relation to regulated contracts are protected in line with the FCA's rules when not in settlement. Please see more at https://bound.co/legal/safeguarding

Why are you cheaper than banks or brokers?

Bound is plugged into a liquidity aggregator. When you enter a quote, several banks and financial institutions compete for your transaction. Bound displays the best quote on your screen with a fixed, transparent spread added. The traditional FX model typically hides costs, particularly when amending transactions. Bound displays transparent spreads not only on booking, but also on amendments and cancellations.

How long does your onboarding take?

1 week or less, depending on how fast you want to move

How does settlement work?

Fund your Bound wallet via a bank transfer (funding cutoff is at 11am GMT). Most currency pairs settle same-day - no cash tied up in advance. Miss a cutoff? The settlement date rolls over to the next day at no cost. All payouts are automated and amounts over $100k are sent via SWIFT with MT103 receipts.

Do you have a floor to start trading?

The minimum is $1M or equivalent per annum. Bound customers typically transact between 7 to 8 figures.

FX is new to me, would a broker be easier?

Our platform is easy to use, and our specialists are here to guide you through setting up your hedges with as much or as little help as you need.

My bank offers me a cheap rate, why would I choose Bound?

Our platform lets you manage everything quickly, without calls or emails to banks or brokers, putting you in control. Enjoy transparent pricing, flexible strategy adjustments, and clear financial insights.

How does your pricing work?

No sign-up fees or hidden costs. Visit our pricing page https://bound.co/tools/spot-forward-pricing for more details.

Is my money safe?

We are regulated by the FCA and all funds in relation to regulated contracts are protected in line with the FCA's rules when not in settlement. Please see more at https://bound.co/legal/safeguarding

Why are you cheaper than banks or brokers?

Bound is plugged into a liquidity aggregator. When you enter a quote, several banks and financial institutions compete for your transaction. Bound displays the best quote on your screen with a fixed, transparent spread added. The traditional FX model typically hides costs, particularly when amending transactions. Bound displays transparent spreads not only on booking, but also on amendments and cancellations.

How long does your onboarding take?

1 week or less, depending on how fast you want to move

How does settlement work?

Fund your Bound wallet via a bank transfer (funding cutoff is at 11am GMT). Most currency pairs settle same-day - no cash tied up in advance. Miss a cutoff? The settlement date rolls over to the next day at no cost. All payouts are automated and amounts over $100k are sent via SWIFT with MT103 receipts.

Do you have a floor to start trading?

The minimum is $1M or equivalent per annum. Bound customers typically transact between 7 to 8 figures.

FX is new to me, would a broker be easier?

Our platform is easy to use, and our specialists are here to guide you through setting up your hedges with as much or as little help as you need.

My bank offers me a cheap rate, why would I choose Bound?

Our platform lets you manage everything quickly, without calls or emails to banks or brokers, putting you in control. Enjoy transparent pricing, flexible strategy adjustments, and clear financial insights.

How does your pricing work?

No sign-up fees or hidden costs. Visit our pricing page https://bound.co/tools/spot-forward-pricing for more details.

Over 200 fast-growing companies use Bound to manage their currency risk

Curious to discover why?

Speak to an expert

Speak to an expert

Speak to an expert