The Dollar's on the Slide, What Are You Doing About It?

The U.S. dollar is having one of its worst runs in decades, down nearly 12% this year. For companies that invoice in dollars and bring that revenue back to GBP or EUR, that’s not just an exchange rate issue. That’s margin erosion.

Many finance teams are sitting tight, hoping for a rebound. But when markets are volatile, driven by politics, tariffs, central bank noise, hope isn’t a strategy.

The Problem: No One Knows When to Convert

You’re selling in USD.

You’ve got costs in GBP.

And the market’s swinging. Every day you wait, you risk:

Losing money to poor rates

Locking in at the worst possible moment

Scrambling after it’s too late

We hear it all the time:

"I don’t know whether to convert now, later, or just wait it out."

What’s driving the dollar’s drop?

Political noise (tariffs, tax changes)

Mounting US debt

Market expectations of rate cuts

A shift away from USD globally

It’s not just about the next week, this could last months or longer. That means currency risk isn’t going away. But neither is your ability to take control of it.

The Smarter Approach: Set Boundaries, Not Bets

We don’t believe in trying to beat the market. We believe in protecting your business from it.

That’s exactly what ManyPets did. They had significant USD to bring back to GBP and didn’t want to gamble on timing. Instead, they put a safety net in place.

The Result? Over £1 million in FX losses avoided in just three months.

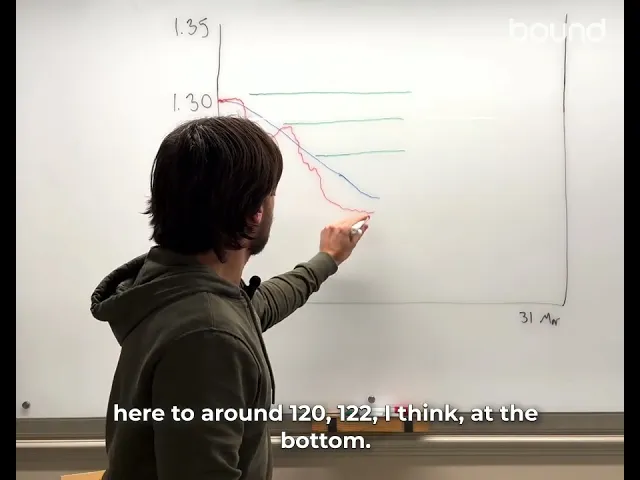

How they did it with Bound’s ‘Ranging’ strategy

Ranging helps companies protect their worst-case rate and benefit from upside if markets move in their favour.

Here's how it works:

Ranging is essentially a combination of two types of orders: a limit order and a stop order.

A stop order locks in your worst acceptable rate by triggering an exchange if the market moves against you.

A limit order locks in your desired rate by setting a price to exchange if the market moves in your favour.

You can also automate a Trailing Stop, which adjusts your stop limit upwards as the market moves in your favour.

One quick win for your team

Ask yourself:

“What’s the worst exchange rate I could accept and still hit our targets?”

From there, we’ll help you build a strategy that protects the downside and gives you upside if markets bounce.

You don’t need a treasury team.

You don’t need to call brokers.

You just need 15 minutes and a plan.

Book a quick call to see how it could work for you