At our recent CFO Breakfast for Growth, we invited two directors from Jefferies – the investment bank known for guiding high-growth companies through fundraising and IPOs – to share their take on the UK’s venture-backed ecosystem. They gave insights into how fundraising is evolving, and the latest in M&A and IPO trends.

Here’s what finance leaders need to know, according to Nandan Shinkre and Vagelis Kollintzas, Head of European Technology and EMEA Head of Financial Technology at Jefferies.

Finding stability in a shifting market

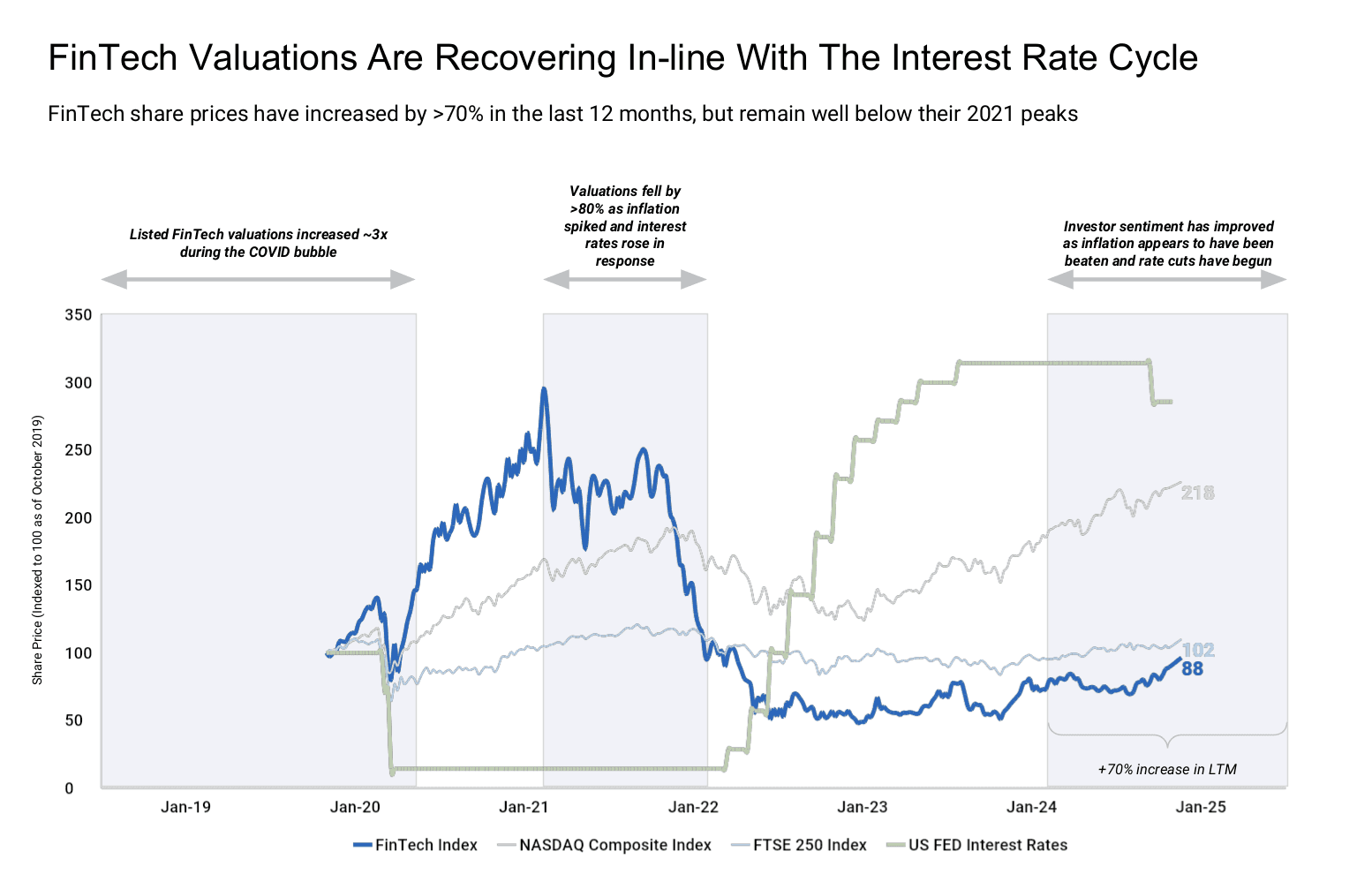

Despite recent challenges, the good news is that Jefferies sees momentum building in the venture-backed space, especially fintech. After the COVID-fuelled boom, which drove high valuations thanks to cheap capital, the market faced a stark correction with rising inflation and interest rates. But indicators now suggest that the ‘fintech winter’ may be ending, with signs of stability and early hints of recovery as we head into 2025.

Fundraising: strong foundations required

The days of securing funding on a high-growth story alone are over. Investors now demand proof of resilience and rigorous structures (and rightly so!). To help their company stand out, finance teams should focus on:

Detailed, transparent diligence: Investors today need a deep dive into a company’s financial health and operational stability. Be ready with well-structured, transparent responses to address key investor questions.

Financial resilience and governance: Investors now expect robust governance and sound financial structures. It’s not just about growth, it’s about how well companies manage compliance, structure operations, and prepare for risk.

Key takeaway: Companies with clear financial governance and transparent frameworks are better positioned to win over today’s more demanding investors

Compliance and governance: more than just box-ticking

Regulators are stepping up compliance requirements, especially for companies eyeing public markets. According to Jefferies, governance has shifted from a ‘nice-to-have’ to a necessity. Today’s investors want stability and compliance-ready frameworks, making robust governance a top priority.

Key takeaway: For companies considering an IPO, building a strong governance framework now is essential for meeting both investor and regulatory expectations

IPO and M&A trends: the new playbook

For companies with IPO ambitions, Jefferies expects a potential uptick in activity towards late 2025. But the approach to IPOs has changed. Today’s strategies need to focus on sustainable, long-term expansion rather than rapid valuation spikes.

UK vs US listings: While the US is still the first choice for large IPOs, given its broad investor base and flexibility, the UK is implementing reforms to up its game. Companies aiming for a US listing should prepare for substantial US presence, a large market cap, and the operational changes needed to meet US investor standards.

M&A potential with cash-rich buyers: With cash reserves accumulated over recent years, major firms like Visa and Mastercard are expected to ramp up M&A activity. Finance teams should ensure their operations are diligence-ready to attract potential buyers.

Key takeaway: IPO strategies now prioritise sustainable growth. Cash-rich buyers are primed for M&A in 2025, so operational readiness is key.

Building a long-term strategy

To sum up, Jefferies’ insights highlight a market that values discipline, transparency, and solid governance. For CFOs and finance teams, this is the time to strengthen internal controls, tighten compliance, and focus on sustainable growth. A clear, long-term approach to financial strategy and governance will be crucial for navigating the complex landscape as 2025 approaches.

For more insights from our CFO Breakfast for Growth, held in partnership with Embat, read our event recap. Or sign up for our future events, so you don’t miss out!

No opinion given in the material constitutes a recommendation by Bound Rates Limited that any particular transaction or investment strategy is suitable for any specific company or person. Results may and will vary. The information in this publication does not constitute legal, tax or other professional advice from Bound Rates Limited or its affiliates.

Stay up to date with insights

Enhance your finance skills by learning from our network of top industry experts